Large chunk of cash to be spent in next two financial years

Up to 600,000 workers will be required to carry out the £164bn of infrastructure investment planned before the next spending review, according to the government.

The Treasury, along with its advisory body the Infrastructure and Projects Authority (IPA), this morning published its National Infrastructure and Construction Pipeline, which sets out plans for major investment in the coming years.

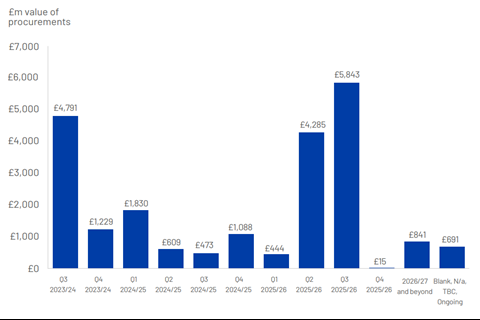

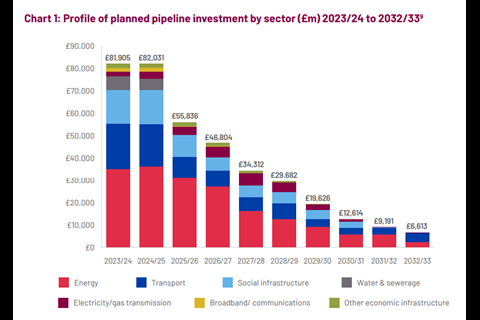

A total of £379bn is planned over the next decade, with a large chunk of that to be spent by 2024/25 when the next spending review is scheduled.

To deliver this, the IPA estimates that an average of 543,000-600,000 workers will be required, 60% of whom will be construction workers.

This is an increase from the 2021 pipeline figure which estimated an average of 425,000 workers required, and reflects the increase in the number of projects covered, up from 528 to 660.

Civil engineers and civil engineering operatives, plant operatives, and plant mechanics/fitters are listed as the types of construction workers most likely to see some level of scarcity in the coming years.

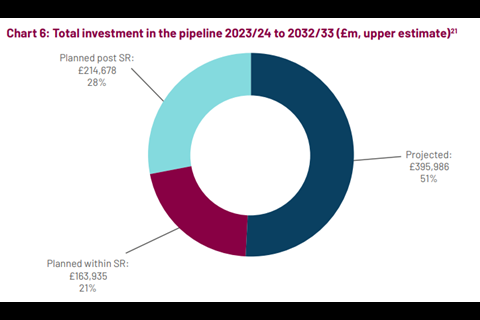

The pipeline also outlined £215bn in planned investment post-spending review and the IPA also made some projections beyond this committed spend.

“Longer term public investment, where it is not already committed, will be determined by future government Spending Reviews,” it said.

“Likewise, the forthcoming spending of regulated utilities will be determined via defined settlement periods.

>> See also: Stimulate economy with building projects, CLC boss tells chancellor

>> See also: Building the Future Commission report: The long-term plan for construction

“To enable the construction industry to have confidence in longer term strategic planning, the IPA uses data from previous years and its own assessment of current trends to provide a 10 year pipeline projection.”

These calculations projected an additional investment of roughly £396bn over the next decade, taking the total planned and projected investment expected to between £700bn and £775bn.

The report highlighted the fact that infrastructure spending was likely to continue to be squeezed by existing challenges, including high construction inflation and systemic issues such as planning delays and low investor confidence.

“The Nationally Significant Infrastructure Project regime has been affected by legal challenges to the efficacy of the National Planning Policy Statements, which are currently being updated,” it said.

“Likewise, the prisons programme has been impacted by the difficulties in achieving planning consents for new facilities.” A scheme Laing O’Rourke is due to build near Chorley in Lancashire under the new prisons propgramme has been held up becasues of Green Belt concerns.

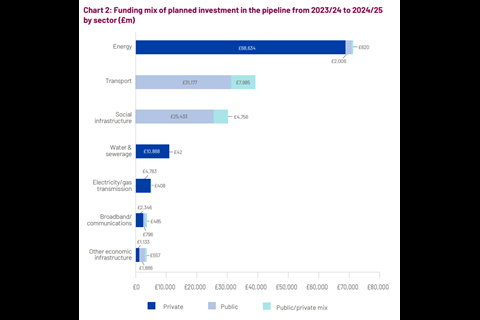

Just over half of the planned pipeline to 2024/25 is privately funded, with privatised sectors including energy and utilities have high proportions of privately financed projects compared with transport and social infrastructure.

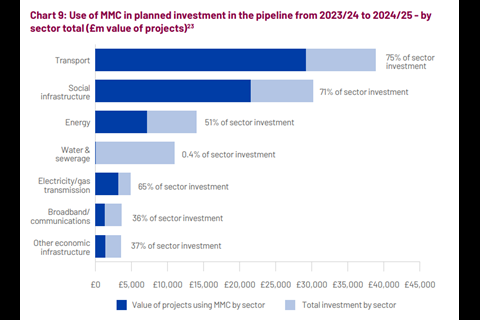

According to the report, £64bn worth of planned investment includes delivery through modern methods of construction.

Transport and social infrastructure are the sectors with the highest known absolute spend in MMC over the next two years, representing 46% and 34% of all MMC spend respectively.

Data on MMC in energy, water and sewerage investment was not as readily available, according to the IPA.

No comments yet