Costing Steelwork is a series from BCSA, Steel for Life and Aecom that provides guidance on costing structural steelwork. This quarter provides a market update by Dr Michael Sansom based on recent CPA forecasts, and data on prices and costs from Pablo Cristi Worm, associate construction economist at Aecom

Click here to read the full costing report

Total UK construction output is now forecast to grow by 1.9% in 2025 and 3.7% in 2026 – a slight downward revision compared with the forecast at the start of the year. Construction had a relatively slow and erratic start to 2025, with activity in January being weather-affected, and activity in February remaining subdued. Activity in March and early April showed an improvement, but both housebuilders and contractors were more cautious than six months ago regarding prospects for 2025.

Even excluding the impacts of US tariff disruption and the beginning of world trade wars in April – which may lead to sharp downward revisions in global and UK economic growth or even recessions – a flat economy was already a concern for the UK; economic growth was only 0.4% in 2023 and 1.1% in 2024. Over the last three months, UK growth forecasts for 2025 have been revised down to only 1.0%, and inflation is expected to remain higher for longer.

The government’s Spring Statement focused on broadly maintaining capital expenditure and identifying cuts in day-to-day spending to ensure it sticks to its fiscal rules. The government also announced £625m for construction skills and £2bn for social and affordable housing; in addition, the building safety levy was delayed for a year. The government has also provided an additional £2.2bn for the Ministry of Defence.

In terms of key risks, the US tariff disruption poses a large threat of causing global and UK economic growth turmoil. At the very least, it has raised the level of uncertainty considerably, leading to a high degree of caution from financial markets and investors. As the tariff issue has developed so recently, there is currently no data covering the post-disruption period. We expect to see more volatile prices for globally traded products. Only around 15% of UK construction products are exported, but the US is the second-largest export market after the Republic of Ireland. For products exported to the US, such as steel and aluminium, the tariffs may have a significant impact.

It is possible that higher US tariffs on Chinese imports may reduce US demand for those products and skew supply to places with lower tariffs, such as the EU, which could ease price inflation for certain goods.

The current uncertainty is likely to mean that if contractors are not sourcing locally made products, there will be more risk and volatility in prices, which may be an issue for firms on fixed-price contracts signed up to 12-24 months ago, when these risks would not have been factored into bids. Greater uncertainty also means a greater risk of higher costs for new projects. This particularly affects larger projects, which require significant upfront investments for a long-term rate of return and where the uncertainty not only affects project costs but also investor confidence. As a result, the greatest impacts could potentially mean a delay or hiatus in contract awards and tenders for new, large commercial, industrial and build-to-rent developments, in addition to private investment in infrastructure.

Other key risks are UK economic growth prospects, contractor insolvencies, the administration of ISG, Building Safety Regulator delays to high-rise projects and the availability and cost of skilled labour.

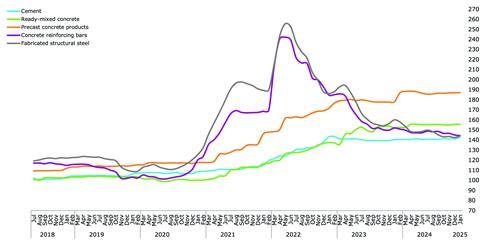

Figure 1: Material price trends

Price indices of construction materials 2015=100. Source: DBEIS

Infrastructure output is forecast to rise by 1.8% in 2025 and 4.5% in 2026. Activity remains strong on major projects such as Hinkley Point C and HS2, and the Lower Thames Crossing has been given the go-ahead as expected but construction work will still not start until 2027. Energy infrastructure activity continues to grow as wind farm activity ramps up again, and increases in capital expenditure in the water sub-sector to deal with high-profile water quality issues will lead to an acceleration in activity from 2026.

Commercial sector output is forecast to be flat (-0.2%) in 2025 as new office towers and large retail or mixed-use projects are pushed back, but this is still expected to be offset by strong work on the refurbishment and fit-out of existing developments. In 2026, refurbishment activity is forecast to be boosted by delayed new tower projects in the pipeline coming through as a result of lower interest rates and financing costs, plus an improvement in wider economic prospects. Growth in 2026 is forecast at 2.7%.

Activity on biotech facilities and data centres continues to remain strong, and these are two areas that may benefit in the medium term from the government’s plans to ease planning, particularly given that the demand is there from private finance for projects.

Conversion of buildings to flats in urban centres or industrial and logistics facilities on the edge of cities also remains strong. Demand for student accommodation is staying strong too, although developers have noted delays on high-rise projects at the pre-construction gateways under the Building Safety Act.

Output in the industrial sector is dominated by the factories and warehouses sub-sectors, which accounted for 96.9% of total sector output in 2024. Warehouse activity remains subdued, due to flatlining economic growth and higher interest rates. Although take-up and investment are reported to have picked up in 2025, activity is likely to return to the levels seen pre-2020.

In contrast, output in the factories sub-sector has proved more resilient over the last 12-18 months, supported by large projects awarded over the last five years related to giga-factories, as well as the manufacture of renewable energy and defence equipment

Total industrial output contracted by 4.7% in 2024, and growth in factories in 2025 is forecast to drive overall sector growth of 1.0%. Growth of 2.6% is expected in 2026 as activity in both factories and warehouses accelerates.

Figure 2: Tender price inflation, Aecom Tender Price Index, 2015=100

| Forecast* | |||||||

|---|---|---|---|---|---|---|---|

|

Quarter |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

|

1 |

120.0 |

131.2 |

145.4 |

145.8 |

150.5 |

156.9 |

164.5 |

|

2 |

122.6 |

134.5 |

146.6 |

147.0 |

151.7 |

158.7 |

166.5 |

|

3 |

125.3 |

138.1 |

146.8 |

148.1 |

153.2 |

160.4 |

168.2 |

|

4 |

127.5 |

142.3 |

145.6 |

149.3 |

155.0 |

162.4 |

170.4 |

Sourcing cost information

Cost information is generally derived from a variety of sources, including similar projects, market testing and benchmarking. Due to the mix of source information it is important to establish relevance, which is paramount when comparing buildings in size, form and complexity.

Figure 3 represents the costs associated with the structural framing of a building, with a BCIS location factor of 100 expressed as a cost/m² on GIFA. The range of costs represents variances in the key cost drivers. If a building’s frame cost sits outside these ranges, this should act as a prompt to interrogate the design and determine the contributing factors.

The location of a project is a key factor in price determination, and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS location factors (figure 3), highlight the existence of different market conditions in different regions.

To use the tables:

1. Identify which frame type most closely relates to the project under consideration

2. Select and add the floor type under consideration

3. Add fire protection as required.

For example, for a typical low-rise frame with a composite metal deck floor and 60 minutes’ fire resistance, the overall frame rate (based on the average of each range) would be:

£173.50 + £114.00 + £34.50 = £322.00

The rates should then be adjusted (if necessary) using the BCIS location factors appropriate to the location of the project.

Figure 3: Indicative cost ranges based on gross internal floor area

| TYPE | Base index 100 (£/m2) | Notes |

|---|---|---|

|

Frames |

||

|

Steel frame to low-rise building |

157-190 |

Steelwork design based on 55kg/m2 |

|

Steel frame to high-rise building |

264-297 |

Steelwork design based on 90kg/m2 |

|

Complex steel frame |

300-354 |

Steelwork design based on 110kg/m2 |

|

Floors |

||

|

Composite floors, metal decking and lightweight concrete topping |

89-139 |

Two-way spanning deck, typical 3m span with concrete topping up to 150mm |

|

Precast concrete composite floor with concrete topping |

136-191 |

Hollowcore precast concrete planks with structural concrete topping spanning between primary steel beams |

|

Fire protection |

||

|

Fire protection to steel columns and beams (60 minutes resistance) |

29-40 |

Factory applied intumescent coating |

|

Fire protection to steel columns and beams (90 minutes resistance) |

36-58 |

Factory applied intumescent coating |

|

Portal frames |

||

|

Large-span single-storey building with low eaves (6-8m) |

113-148 |

Steelwork design based on 35kg/m2 |

|

Large-span single-storey building with high eaves (10-13m) |

138-177 |

Steelwork design based on 45kg/m2 |

Figure 4: BCIS location factors, as at Q2 2025

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

|

Central London |

125 |

Nottingham |

101 |

|

Manchester |

103 |

Glasgow |

93 |

|

Birmingham |

98 |

Newcastle |

89 |

|

Liverpool |

98 |

Cardiff |

103 |

|

Leeds |

90 |

Dublin |

90* |

*Aecom index

Steel For Life sponsors

Ditch the risk switch

Excessive amendment of standard forms – especially on risk allocation – undermines conflict avoidance. Deborah Harrison, BCSA legal director, offers five ways to improve the use of specialist contracts

In the construction industry we are fortunate to have a series of standard form contracts to suit almost any construction and engineering project. In 1870, the Royal Institute of British Architects got together with the Society of Builders (now the Chartered Institute of Building or CIOB) to produce the precursor to what became the JCT building contract.

Standard form contracts were drafted as a way of determining fair and proportionate risks between the parties. Yet rarely at BCSA do our members see an unamended standard form contract, and we know that we are not alone: other specialist contractors have the same issues.

Recently the trend has been to amend every key clause and a complete risk switch in JCT or NEC contracts, and for these sets of amendments to run to 150 pages, passing the risks lower down through the supply chain to companies that do not have a raft of specialist construction lawyers at their fingertips. The number of hours it takes to review and agree these terms only adds to the cost of the project.

We offer free contract reviews as part of BCSA member services, so naturally perhaps we see the worst of their kind. But, after so many industry attempts at a collaborative approach, particularly now we are 30 years on from the Latham report, it is dispiriting to see such a costly and adversarial approach to getting into contract commonly still put forward by clients and major contractors.

BCSA have recently signed the RICS Conflict Avoidance Pledge which was initiated by several of the UK’s leading professional bodies for construction and engineering. We are members of the Conflict Avoidance Contract Group which seeks to promote the use of unamended (or lightly amended for project-specific detail) standard form contracts throughout the industry. Conflict avoidance starts with the contract.

Here are five ways to immediately improve yours:

1. Stop the wholesale amendment of standard form clauses

Use standard form contracts where possible. If there are particular policies and practices to comply with, then these can be incorporated in numbered documents or appendices and referred to in particulars or schedules. The Construction Playbook states that: “Inappropriate allocation of risk remains one of the main concerns of suppliers looking to do business with government. It is also one of the most frequent issues raised by the National Audit Office in their audits of government contracts.”

2. Payment within 30 days

The Procurement Act 2023 mandates payment within 30 days throughout the supply chain on public sector projects. Yet still we see subcontracts on the same projects with 45, 90 or 120 day payment terms. The Small Business Commissioner’s Fair Payment Code encourages businesses across the UK to pay fairly and quickly and to pay 95% of their invoices within 30 days.

The Building a Safer Future 2018 report identifies that: “Payment terms within contracts […] can drive poor behaviours, by putting financial strain into the supply chain. For example non-payment of invoices and consequent cash flow issues can cause subcontractors to substitute materials purely on price rather than value for money or suitability for purpose.”

3. Stop the design risk switch

It is common practice, but nonsensical, to amend standard form contracts to pass down the responsibilities of verifying the designs carried out by the main client’s professional team to the specialist subcontractor, who has no contractual relationship with that team and often does not have the correct competency to review those designs. The Grenfell Phase 2 report commented that the principal contractor relied on the cladding subcontractor to draw attention to any errors in the architect’s design. The cladding subcontractor did not have the knowledge to evaluate this information.

4. Stop incorporation by reference

If you would like your specialist subcontractor to take account of a particular agreement, it needs to be provided before the prices are agreed – preferably a relevant extract only, at least sent electronically and listed as a contract document with an unambiguous document reference. It is not sufficient in this day and age for key documents such as the main contract to reside at the registered office “for inspection”.

5. Keep it covered: stay within the remit of insurable risks

It is in the interests of all parties not to expand liability beyond what is covered by professional indemnity insurance and far easier to claim on insurance than against a contractor’s business. The specialist contractor’s insurance level is unlikely to be on a par with a larger main contractor, yet often the amount of PII required is (nonsensically) copied and pasted into the subcontract. And the more frills and furbelows – warranties, indemnities, fitness for purpose, diligence etc – you add to the standard of care, the less likely the insurer will pay out.

Ditch the switch: want to find out about ways to improve your specialist contract now?

The BCSA is hosting a webinar on this subject, presented by Mrs Deborah Harrison on 9 September 2025 from 12pm to 1pm.

The webinar will aim to talk through some of the worst risk-switching bespoke amendments to standard form subcontracts and how to deal with them. In particular: design risk, scope creep, obligations in ancillary documents, indemnities, penalties and contra-charging.

To register your attendance, click here.

The Costing Steelwork article produced by Dr Michael Sansom (sustainability director) of BCSA is available at www.steelconstruction.info. The pricing data and rates contained in this article have been produced by Pablo Cristi Worm, associate construction economist at Aecom. They should be used for comparative purposes only and should not be used or relied upon for any other purpose without further discussion with Aecom. Aecom does not owe a duty of care to the reader or accept responsibility for any reliance on the contents of the article.

No comments yet