Costing Steelwork is a series from BCSA, Steel for Life and Aecom that provides guidance on costing structural steelwork. This quarter provides a market update by Dr Michael Sansom based on recent CPA forecasts, and data on prices and costs from Pablo Cristi Worm, associate construction economist at Aecom

Click here to read the full costing report

Total UK construction output is forecast to grow by 1.1% in 2025 and 2.8% in 2026, both downward revisions from the summer outlook of 1.9% and 3.7% respectively. Public sector programmes, energy infrastructure and industrial investment will underpin this growth, with the recovery in housing and major commercial developments more subdued.

UK GDP growth was slightly positive in 2025 Q1 and Q2, and this is likely to have continued into Q3. The macro‑economic backdrop is still challenging. Inflation remains sticky, interest rates are likely to fall more slowly than previously expected, and the government’s autumn Budget, with unspecified tax rises, has sparked nervousness among businesses and households. Both consumer spending and business investment are being deferred pending fiscal clarity. There also remains uncertainty as to whether the government will also cut back on some of the capital investment plans outlined in the June Spending Review.

The public sector is expected to grow faster than the private sector, reflecting sustained spending on schools, hospitals, defence and infrastructure frameworks. Overall, the industry will remain below its 2021 output peak until at least 2027.

Private housing and repair, maintenance and improvement (RM&I) activity remain weak due to affordability constraints, tax uncertainty and subdued consumer confidence. In contrast, energy infrastructure, water investment and high‑tech manufacturing are expected to deliver solid medium‑term expansion. Niche areas of opportunity include data centres, giga-factories and logistics facilities linked to electrification and AI; energy‑efficiency retrofits and fire safety remediation; and smaller, high‑quality commercial refurbishments and fit‑outs.

Key risks and constraints persist, including:

- Contractor insolvencies: Although down from their 2024 peak, insolvencies remain around 25% above pre‑pandemic levels, threatening supply‑chain continuity.

- Building Safety Regulator delays: Continuing six- to nine‑month hold‑ups at gateway 2 (and three to four months at gateway 3) constrain starts on high‑rise residential, student housing and healthcare schemes.

- Skills and labour shortages: Construction employment is still well below 2019; loss of older skilled workers and reduced EU labour supply persist. Wage inflation (around 4%-5% year on year) squeezes contractors.

Material price inflation has largely flattened through 2025 and there has been little volatility in material cost inflation, indicating prices have stabilised after extreme spikes in 2022-23. Supply chain firms confirm input cost inflation has largely eased, and materials availability is now generally good, although overall prices remain around 20%-30% higher than 2019 levels.

Supply chain conditions normalised during 2024 and 2025: lead times shortened, and availability of key materials (steel, timber, aggregates, cement, insulation) is no longer a major constraint on construction activity.

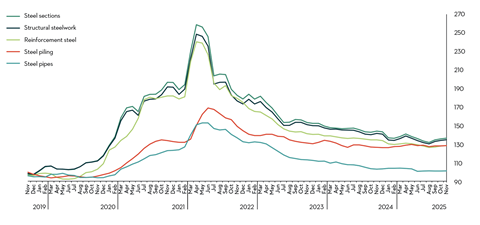

Figure 1: Steel cost indices

Assorted cost indices of construction steel 2019=100. Source: Building Cost Information Service (BCIS)

Infrastructure, valued at £29.7bn in 2024, is the third‑largest construction sector. Output is forecast to rise by 2.6% in 2025 and 3.9% in 2026, led by energy and utilities rather than transport. Policy uncertainty on transport priorities undermine planning and pipeline visibility, and dependence on private finance for mega‑projects exposes schedules to market confidence and cost risk.

Industrial construction output fell 4.5% in 2024 to £7.4bn after the post‑pandemic correction of the logistics boom, but now has a forecast growth of 4.1% in 2025 and 2.6% in 2026. Giga-factories, battery, renewable and low carbon manufacturing present growth opportunities, but speculative warehousing and logistics development remains subdued – although activity is stabilising at a sustainable new normal, with a shift to automated smart warehouses and regional distribution hubs.

The commercial sector, valued at £25bn in 2024, continues to face headwinds. Output is forecast to fall 1.9% in 2025 before a 2.3% rebound in 2026. Investor caution, high construction and financing costs, and weak occupier demand in traditional office markets contribute to sluggish activity.

New‑build office towers remain constrained; many pre‑pandemic concepts are no longer viable. Activity concentrates on premium fit‑outs and energy‑efficient retrofits, driven by MEES (target EPC C by 2027). University and research projects remain relatively robust and biotech and labs continue to attract long‑term capital. Student housing demand is high but starts are delayed by the Building Safety Regulator. Data centres remain the standout growth area; UK digital infrastructure demand continues to attract global investment.

The autumn 2025 UK construction forecast portrays an industry still navigating significant uncertainty but showing tentative signs of recovery. The overarching message is one of slow, uneven growth driven by publicly supported infrastructure and industrial transformation, while private housing and commercial new-build remain constrained by affordability and finance conditions.

In the near term, the industry’s fortunes hinge on the autumn Budget and the path of inflation and interest rates. Even modest policy clarity could unlock deferred private investment; conversely, further fiscal tightening could prolong stagnation into 2026. Over the medium term, demand is shifting toward strategic national investment (energy, water, industrial capacity) and sustainable refurbishment of existing assets. With selective opportunities in data centres, life sciences and high‑quality retrofit, the sector enters 2026 leaner but positioned to grow steadily once macroeconomic confidence returns.

Figure 2: Tender price inflation, Aecom Tender Price Index, 2015=100

| Forecast* | |||||||

|---|---|---|---|---|---|---|---|

|

Quarter |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

|

1 |

120.0 |

131.2 |

145.4 |

145.8 |

150.1 |

155.4 |

161.7 |

|

2 |

122.6 |

134.5 |

146.6 |

147.0 |

151.5 |

156.9 |

163.2 |

|

3 |

125.3 |

138.1 |

146.8 |

148.2 |

152.7 |

158.5 |

164.8 |

|

4 |

127.5 |

142.3 |

145.6 |

149.3 |

153.8 |

160.1 |

166.4 |

Sourcing cost information

Cost information is generally derived from a variety of sources, including similar projects, market testing and benchmarking. Due to the mix of source information it is important to establish relevance, which is paramount when comparing buildings in size, form and complexity.

Figure 3 represents the costs associated with the structural framing of a building, with a BCIS location factor of 100 expressed as a cost/m² on GIFA. The range of costs represents variances in the key cost drivers. If a building’s frame cost sits outside these ranges, this should act as a prompt to interrogate the design and determine the contributing factors.

The location of a project is a key factor in price determination, and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS location factors (figure 3), highlight the existence of different market conditions in different regions.

To use the tables:

1. Identify which frame type most closely relates to the project under consideration

2. Select and add the floor type under consideration

3. Add fire protection as required.

For example, for a typical low-rise frame with a composite metal deck floor and 60 minutes’ fire resistance, the overall frame rate (based on the average of each range) would be:

£175.00 + £131.00 + £34.50 = £340.50

The rates should then be adjusted (if necessary) using the BCIS location factors appropriate to the location of the project.

Figure 3: Indicative cost ranges based on gross internal floor area

| TYPE | Base index 100 (£/m2) | Notes |

|---|---|---|

|

Frames |

||

|

Steel frame to low-rise building |

159-191 |

Steelwork design based on 55kg/m2 |

|

Steel frame to high-rise building |

266-301 |

Steelwork design based on 90kg/m2 |

|

Complex steel frame |

304-364 |

Steelwork design based on 110kg/m2 |

|

Floors |

||

|

Composite floors, metal decking and lightweight concrete topping |

111-151 |

Two-way spanning deck, typical 3m span with concrete topping up to 150mm |

|

Precast concrete composite floor with concrete topping |

138-194 |

Hollowcore precast concrete planks with structural concrete topping spanning between primary steel beams |

|

Fire protection |

||

|

Fire protection to steel columns and beams (60 minutes resistance) |

29-40 |

Factory applied intumescent coating |

|

Fire protection to steel columns and beams (90 minutes resistance) |

36-58 |

Factory applied intumescent coating |

|

Portal frames |

||

|

Large-span single-storey building with low eaves (6-8m) |

114-149 |

Steelwork design based on 35kg/m2 |

|

Large-span single-storey building with high eaves (10-13m) |

139-178 |

Steelwork design based on 45kg/m2 |

Figure 4: BCIS location factors, as at Q4 2025

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

|

Central London |

122 |

Nottingham |

102 |

|

Manchester |

102 |

Glasgow |

92 |

|

Birmingham |

98 |

Newcastle |

89 |

|

Liverpool |

100 |

Cardiff |

102 |

|

Leeds |

90 |

Dublin |

90* |

*Aecom index

Steel For Life sponsors

Brush up your coating skills

Learn about how to reduce coating failures on structural steel with the Responsible Coatings Professionals course, which covers all the essential topics needed for a coatings applicator, specifier or inspector

The coating of structural steel has always been an integral element of a project for fabricators, whether carried out in-house or by a third party. However, when the coating fails or an issue arises, it can be one of the costliest elements to rectify, especially if the steelwork has been installed. In addition to this, with the Building Safety Act regulations being rolled out, there is a much greater emphasis on fire protection, with conflicting views on the application of intumescents in the project supply chain.

To address this, BCSA has developed a training course, which is specific to the painting of constructional steelwork and has been designed to educate those professionals in the supply chain who have responsibility for protective and intumescent coatings but would like more knowledge to better manage risks.

The Responsible Coatings Professionals course was developed by industry professionals, with endorsement from a variety of associated companies and the British Coatings Federation. It covers all the essential topics that a coatings applicator, specifier or inspector needs to consider, to effectively undertake their role.

The course adopts key European Standards as used by the industry, with key topics including:

- Basic corrosion theory

- Fundamentals of protective coatings (corrosion and fire protection)

- Quality control theory and practice (environmental checks, surface preparation, pre- and post-application testing)

- Coating specifications

- Hands-on experience of surface preparation and spray painting.

The course is delivered over four days by course instructors who are well known, highly experienced, senior industry professionals. Class sizes are kept to under 12 delegates, to ensure that all attending have practical experience of using all 12 test instruments relevant to structural steel. In addition, there is a practical session where attendees have the opportunity to blast and paint a steel panel to a given specification and then test it to see if it meets the requirements. The course concludes with a test and, upon successful completion, a certificate is awarded to demonstrate competence and aptitude.

If you want to manage and mitigate your risks, where possible, or upskill your workforce, why not book a place on the course and learn from the best in the industry. The next course dates are: 2-6 February 2026 but you can also add your name to the contact list to be notified of future dates.

To find out more, please visit: https://qrco.de/bgQ8T3

The Costing Steelwork article produced by Dr Michael Sansom (sustainability director) of BCSA is available at www.steelconstruction.info. The pricing data and rates contained in this article have been produced by Pablo Cristi Worm, associate construction economist at Aecom. They should be used for comparative purposes only and should not be used or relied upon for any other purpose without further discussion with Aecom. Aecom does not owe a duty of care to the reader or accept responsibility for any reliance on the contents of the article.

No comments yet