Costing Steelwork is a series from Aecom, BCSA and Steel for Life that provides guidance on costing structural steelwork. This quarter provides a market update and updates the five cost models previously featured in Costing Steelwork

For a digital edition version of this update, click here

Business sentiment in the UK remains subdued as political and economic uncertainty weighs on confidence. Almost all business surveys underscore the shadow cast by Brexit, which is impacting order books and dampening investment intentions. Recent developments in international trade negotiations have hit some turbulence, on top of slower global economic conditions. This continues the UK’s story of export orders declining at the fastest rate since the financial crisis.

However, when Brexit is resolved, more clarity ought to be available to enable the restart of projects on hold, although conditions would need to be favourable to frame the decision-making process. Nevertheless, Brexit has implications for a growing proportion of firms in the construction supply chain – its present and future effects will flow through to the strategic and operational levels of construction firms. As the Brexit denouement approaches, it will also begin to extend through into necessary firm-level tactical responses.

Construction all work output moved negligibly in Q2 2019 – falling marginally quarter-on-quarter by -0.8% but increasing slightly over the year by 0.5%. Current headline output levels suggest an industry that is near its long-run average. The key question is what the direction of the output trend is now, especially given the economic and political backdrop. New orders in Q2 decreased by 13.3% after posting an increase of 10.4% in Q1 2019. The fall was across all sectors except for infrastructure, which recorded 0.8% growth versus the first quarter of the year.

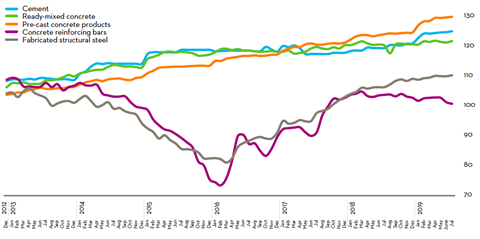

Aecom’s composite index for building costs – comprised of materials and labour inputs – rose by 4% over the year at Q2 2019. The supply chain retains the view that materials and labour costs will increase further over the remainder of 2019. This reflects current workload, visibility of next immediate projects and some ongoing difficulties securing trade resources. The prevailing weakness of sterling also continues to play a large part in the commercial pressures arising from input costs.

Forecasts of input cost inflation over the remainder of 2019 and into 2020 are at a lower headline rate of 3-4%. However, localised demand and supply might result in pinch points to create higher rates of cost inflation. In the event of a “no-deal” Brexit, additional risks would be likely to materialise from non-tariff barriers. The time-related issues associated with the management of non-tariff barriers have the potential to adversely impact strategic and operational aspects of the supply chain. Ultimately, delays to imported materials and components arising from disruption at UK ports would likely lead to project delivery issues, unless mitigation strategies are already in place.

Capacity utilisation across the industry remains somewhat elevated, despite sentiment softening in recent months. Until the middle of the year, labour market tightness contributed to the assessment of overall capacity utilisation. In turn, an aggregate measure of wage rates for site labour recorded 4-5% growth over the year – still notably above headline consumer price inflation in the UK. This continues the trend of strong wage growth on a real terms basis for the construction sector. However, tight labour supply as a constraint on output has eased since the middle of the year, and there is expected to be some knock-on to wage growth.

| Forecast | |||||||

|---|---|---|---|---|---|---|---|

|

Quarter |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

1 |

96.0 |

105.8 |

110.9 |

113.2 |

117.9* |

120.4 |

121.8 |

|

2 |

98.6 |

107.7 |

111.3 |

113.6 |

118.3 |

120.8 |

123.0 |

|

3 |

101.5 |

108.7 |

112.2 |

115.4 |

119.1 |

121.2 |

124.1 |

|

4 |

103.8 |

109.9 |

112.6 |

117.3 |

119.8 |

121.4 |

124.3 |

Tender prices increased by 4.3% over the year at Q2 2019, driven predominantly by elevated input cost trends. Available work has placed a floor under market pricing until now, such that prices have not been trimmed considerably. But there is not enough potential work to increase prices either. Tender competition is also increasing in the market place and this will eventually lead to commercial decisions around price and risk acceptance.

Aecom’s baseline forecasts for tender price inflation are 1.8% from Q3 2019 to Q3 2020, and 2.6% from Q3 2020 to Q3 2021. Assumptions underpinning the forecasts include output reverting to a long-run average without excessive volatility; elevated input costs as a result of weak, if not weaker, sterling; resource constraints and an orderly Brexit arrangement generating positive risks from a synchronised release of held projects. Downside risks are linked to a disorderly Brexit process. Additionally, a downside skew to the assessed risks accompanying the price forecasts results from sustained economic and political uncertainty.

Sourcing cost information

Cost information is generally derived from a variety of sources, including similar projects, market testing and benchmarking. Due to the mix of source information it is important to establish relevance, which is paramount when comparing buildings in size, form and complexity.

Figure 3 represents the costs associated with the structural framing of a building, with a BCIS location factor of 100 expressed as a cost/m² on GIFA. The range of costs represents variances in the key cost drivers. If a building’s frame cost sits outside these ranges, this should act as a prompt to interrogate the design and determine the contributing factors.

The location of a project is a key factor in price determination, and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS location factors (figure 4), highlight the existence of different market conditions in different regions.

To use the tables:

- Identify which frame type most closely relates to the project under consideration

- Select and add the floor type under consideration

- Add fire protection as required.

For example, for a typical low-rise frame with a composite metal deck floor and 60 minutes’ fire resistance, the overall frame rate (based on the average of each range) would be:

£111.50 + £78.00 + £17.00 = £206.50

The rates should then be adjusted (if necessary) using the BCIS location factors appropriate to the location of the project.

| Type | Base index 100 (£/m2) | Notes |

|---|---|---|

|

Frames |

|

|

|

Steel frame to low-rise building |

101-122 |

Steelwork design based on 55kg/m2 |

|

Steel frame to high-rise building |

169-191 |

Steelwork design based on 90kg/m2 |

|

Complex steel frame |

191-226 |

Steelwork design based on 110kg/m2 |

|

Floors |

|

|

|

Composite floors, metal decking and lightweight concrete topping |

61-95 |

Two-way spanning deck, typical 3m span, with concrete topping up to 150mm |

|

Precast concrete composite floor with concrete topping |

101-142 |

Hollowcore precast concrete planks with structural concrete topping spanning between primary steel beams |

|

Fire protection |

|

|

|

Fire protection to steel columns and beams (60 minutes’ resistance) |

14-20 |

Factory-applied intumescent coating |

|

Fire protection to steel columns and beams (90 minutes’ resistance) |

16-29 |

Factory-applied intumescent coating |

|

Portal frames |

|

|

|

Large-span single-storey building with low eaves (6-8m) |

75-98 |

Steelwork design based on 35kg/m2 |

|

Large-span single-storey building with high eaves (10-13m) |

86-118 |

Steelwork design based on 45kg/m2 |

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

|

Central London |

128 |

Nottingham |

106 |

|

Manchester |

100 |

Glasgow |

92 |

|

Birmingham |

95 |

Newcastle |

89 |

|

Liverpool |

96 |

Cardiff |

89 |

|

Leeds |

90 |

Dublin |

96* |

Cost comparison updates

This quarter’s Costing Steelwork provides an update of the five previously featured cost comparisons covering: offices, education, industrial, retail and mixed-use

These five projects were originally part of the Target Zero study conducted by a consortium of organisations including Tata Steel, Aecom, SCI, Cyril Sweett and the BCSA in 2010 to provide guidance on the design and construction of sustainable, low- and zero-carbon buildings in the UK. The cost models for these five projects have been reviewed and updated as part of the Costing Steelwork series. The latest cost models as of Q3 2019 are presented here.

Costing steelwork: offices update

Below is an update to the offices cost comparison originally published in the Costing Steelwork Offices feature in Building magazine in April 2017.

One Kingdom Street, London, key features

- 10 storeys, with two levels of basement

- Typical clear spans of 12m x 10.5m

- Three cores – one main core with open atrium, scenic atrium bridges and lifts

- Plant at roof level

Cost comparison

Two structural options for the office building were assessed (as shown in figure 5):

- Base case – a steel frame, comprising fabricated cellular steel beams supporting a lightweight concrete slab on a profiled steel deck

- Option 1 – 350mm-thick post-tensioned concrete flat slab with a 650mm x 1,050mm perimeter beam.

The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q3 2019. Movement has continued to be relatively static from Q2 2019. The costs, which include preliminaries, overheads, profit and a contingency, are summarised in figure 5.

The cost of the steel composite solution is 8% lower than that for the post-tensioned concrete flat slab alternative for the frame and upper floors, and 5% lower on a total building basis.

| Elements | Steel composite | Post-tensioned concrete flat slab |

|---|---|---|

|

Substructure |

89 |

94 |

|

Frame and upper floors |

438 |

472 |

|

Total building |

2,633 |

2,775 |

Costing steelwork: education update

Below is an update to the education cost comparison originally published in the Costing Steelwork Education feature in Building magazine in July 2017.

Christ the King Centre for Learning, Merseyside, key features

- Three storeys, with no basement levels

- Typical clear spans of 9m x 9m

- 591m2 sports hall (with glulam frame), 770m2 activity area and atrium

- Plant at roof level

Cost comparison

Three structural options for the building were assessed (as shown in figure 6), which include:

- Base case – steel frame, 250mm hollowcore precast concrete planks with 75mm structural screed

- Option 1 – in situ 350mm reinforced concrete flat slab with 400mm x 400mm columns

- Option 2 – steel frame, 130mm concrete topping on structural metal deck.

The full building cost plans for each option have been updated to provide current costs at Q3 2019. The comparative costs highlight the importance of considering total building cost when selecting the structural frame material. The concrete flat slab option has a marginally lower frame and floor cost compared with the steel composite option, but on a total-building basis the steel composite option has a lower overall cost (£3,189/m2 against £3,158/m2). This is because of lower substructure and roof costs, and lower preliminaries resulting from the shorter programme.

| Elements | Steel + precast hollow-core planks | In situ concrete flat slab | Steel composite |

|---|---|---|---|

|

Frame and upper floors |

292 |

252 |

265 |

|

Total building |

3,189 |

3,158 |

3,132 |

Costing steelwork: industrial update

Below is an update to the industrial cost comparison originally published in the Costing Steelwork Industrial feature in Building magazine in October 2017.

Distribution warehouse in ProLogis Park, Stoke-on-Trent, key features

- Warehouse: four-span, steel portal frame, with a net internal floor area of 34,000m2

- Office: 1,400m2, two-storey office wing with a braced steel frame with columns

Cost comparison

Three frame options were considered:

- Base option – a steel portal frame with a simple roof solution

- Option 1 – a hybrid option: precast concrete column and glulam beams with timber rafters

- Option 2 – a steel portal frame with a northlight roof solution.

The full building cost plans for each option have been updated to provide costs at Q3 2019. The steel portal frame provides optimum build value at £686/m2; glulam is least cost-efficient. This is primarily due to the cost premium for the structural members necessary to provide the required spans, which are otherwise efficiently catered for in the steelwork solution. With a hybrid, the elements are from different suppliers, which raises the cost. The northlights option is directly comparable with the portal frame in relation to the warehouse and office frame. The variance is in the roof framing as the northlights need more. Other additional costs relate to the glazing of the northlights.

| Elements | Steel portal frame | Glulam beams + purlins + concrete columns | Steel portal frame + north-lights |

|---|---|---|---|

|

Warehouse |

70 |

142 |

83 |

|

Office |

129 |

171 |

129 |

|

Total frame |

74 |

143 |

87 |

|

Total building |

686 |

767 |

736 |

Costing steelwork: retail update

Below is an update to the retail cost comparison originally published in the Costing Steelwork retail feature in Building magazine in January 2018.

Asda food store, Stockton-on-Tees, key features

- Total floor area of 9,393m2

- Retail area based on 12m x 12m structural grid

Cost comparison

Three frame options were considered (as shown in figure 8) to establish the optimum solution for the building, as follows:

- Base option – a steel portal frame on CFA piles

- Option 1 – glulam timber rafters and columns on CFA piles

- Option 2 – a steel portal frame with a northlight roof solution on driven steel piles.

The full building cost plans for each option have been updated to provide costs at Q3 2019. The steel portal frame provides the optimum build value at £2,607/m2, with the glulam option the least cost-efficient. The greater cost is due to the direct comparison of the steel frame solution against the glulam columns and beams/rafters. A significant proportion of the building cost is in the M&E services and fit-out elements, which reduce the impact of the structural changes.

The northlights option is directly comparable to the portal frame in relation to the main supermarket; the variance is in the roof framing as the northlights require more. Additional costs beyond the frame are related to the glazing of the northlights and the overall increase in relative roof area.

| Elements | Steel portal frame | Glulam timber rafters + columns | Steel portal frame + north-lights |

|---|---|---|---|

|

Structural unit cost |

143 |

175 |

161 |

|

Total building unit cost |

2,607 |

2,647 |

2,617 |

Costing steelwork: mixed-use update

Below is an update to the mixed-use cost comparison originally published in the Costing Steelwork mixed-use focus feature in Building magazine in April 2018.

Holiday Inn tower, MediaCityUK, Manchester

- 17-storey tower

- 7,153m2 of open-plan office space on five floors (floors two to six)

- 9,265m2 of hotel space on eight floors (floors eight to 15)

The gross internal floor area of the building is 18,625m2. The 67m-high building is rectilinear with approximate dimensions of 74m x 15.3m.

Cost comparison

Three frame options were considered to establish the optimum solution for the building:

- Base option – steel frame with Slimdek floors

- Option 1 – concrete flat slab

- Option 2 – composite deck on cellular beams (offices) and UCs used as beams (hotel).

The full building cost plans for each option have been updated to provide costs at Q3 2019. The steel frame with composite deck continues to provide the optimum build value with the overall building cost at £2,578/m2.

Options 1 and 2 are arguably more typical for this building type. The base case structure is an unusual solution due to a decision to change the residential accommodation to office floors at a very late stage; time constraints precluded redesign of the tower block and hence the original Slimdek design was constructed.

| Elements | Steel frane with Slimdek | Concrete flat slab | Composite deck on cellular beams (offices) and UCs used as beams (hotel) |

|---|---|---|---|

|

Structural unit cost |

513 |

429 |

351 |

|

Total building unit cost |

2,786 |

2,683 |

2,578 |

This Costing Steelwork article produced by Patrick McNamara (director) and Michael Hubbard (associate) of Aecom is available at www.steelconstruction.info.

The data and rates contained in this article have been produced for comparative purposes only and should not be used or relied upon for any other purpose without further discussion with Aecom. Aecom does not owe a duty of care to the reader or accept responsibility for any reliance on the article contents.

Steel for Life sponsors:

Headline

ArcelorMittal | Barratt Steel Limited | Jamestown

Gold

Ficep UK Ltd | National Tube Stockholders and Cleveland Steel & Tubes | Peddinghaus Corporation | voestalpine Metsec plc | Wedge Group Galvanizing Ltd

Silver

Jack Tighe Ltd | Kaltenbach Ltd | Tata Steel | Trimble Solutions (UK) Ltd

No comments yet