When PC Harrington Contractors collapsed into administration in May, it had debts of around £28.4m and just £900 cash in the bank. We reveal the true story of the firm’s demise

Tomorrow the creditors for PC Harrington Contractors will meet to attempt to discover just what can be salvaged from the wreckage of one of the biggest concrete specialists in the UK, which collapsed into administration at the start of May. Responsible for the formwork on high-profile projects from 20 Fenchurch Street – the Walkie Talkie – to Wembley Stadium, the £65m turnover firm built a reputation over almost 50 years as both one of the most respected but also one of the more media-shy major firms in the industry.

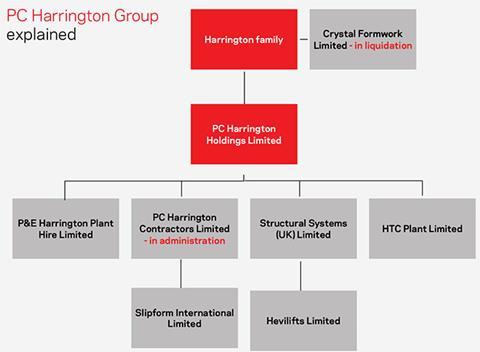

PC Harrington Contractors (PCHC) is the biggest part of the £114m turnover PC Harrington Group. The group’s founder, 77 year-old Patrick Christopher Harrington, has kept out of the media spotlight, with the company routinely refusing to answer media enquiries made over phone or email. This determinedly low profile meant the growing problems facing the family-run PCHC (four of nine directors at the time of administration had the surname Harrington) were largely kept out of the public eye. But now an unpublished document from PCHC’s administrator, KPMG, seen exclusively by Building, as well as statutory information on the firm and other firms in the Harrington group of companies - most of which are still trading – makes it possible to piece together the story of PCHC’s demise. The documents reveal that PCHC, which was working on major contracts including Land Securities’ £400m Nova Victoria scheme, fell from grace so severely that by the time KPMG was finally appointed administrator on 8 May, the firm owed its suppliers £12m, but had just £900 of cash in the bank. The documents also shed light on a group with a structure in which all of PCHC’s employees were actually employed by an unrelated firm owned by the Harrington family.

As with most contractors that went under during the seven long years since the financial collapse in 2008, the demise of PCHC had its roots in particular jobs. A Joint Administrators’ proposals document, sent to creditors on 4 June and seen by Building, states baldly that “in recent times the company experienced contract disputes and suffered losses on a number of major contracts”. Neither this report nor PCHC’s statements to Companies House name which jobs were responsible for the company’s initial cash-flow difficulties, and when contacted, a spokesperson for the administrator KPMG declined to comment. However, PCHC worked on a number of schemes which are known to have experienced difficulties. These include the £150m Design Museum’s new home at the former Commonwealth Institute, the opening of which has been delayed by a year with the museum blaming the “complexity of the renovation” of the building. PCHC also worked on the £200m Fitzroy Place job, which the scheme’s overall contractor Sir Robert McAlpine has already admitted made a major contribution to its recent near £100m loss.

KPMG’s report doesn’t say exactly when PCHC’s problems started, though we now know from company accounts published in March this year that the firm made a £4.1m loss for the year to the end of May 2014, on revenues of £64.7m. It also restructured its management team in April 2014, promoting Laing O’Rourke veteran Duncan Salt, who had joined the firm in 2012, to director.

The company experienced contract disputes and suffered losses on a number of major contracts

Joint administrators’ proposals document

From the outside, however, there was at this stage nothing to suggest any cause for concern. The first external signs something was wrong came - if you knew where to look - in a statutory filing by a firm called Crystal Formwork in December last year. CrystaFormwork – which had been known as PC Harrington Formwork until two months earlier – is not part of the Harrington group. However, according to KPMG’s administration proposals, the firm exists for the purpose of employing the staff that undertook work for PC Harrington Contractors, and is held separate from the group under common ownership by the Harrington family. The filing said Crystal Formwork approved the setting up of a Company Voluntary Arrangement, or CVA – which is basically a formalised debt repayment schedule - in November last year in a bid to pay debts including a £3.99m debt to HM Revenue and Customs and other debts to Harrington Group companies. As CVAs are a way to give debtors a breathing space on repayments in order to gain time to turn a company around, it was a sure sign of difficulties.

While this was happening, auditors signed off PCHC’s revealing 2014 accounts, although these were not made public until months later.

Meanwhile PCHC was starting to get a reputation in the market for poor payment of debts. According to credit reference agency Top Service, the agency acted for 18 different companies that were trying to collect debts owed them in the six months before PCHC went into administration. PCHC also lost county court judgments, including six in the last two months alone. KPMG’s proposals document says the company was also named in several formal recovery actions by creditors.

KPMG’s document shows that PCHC was now under “significant pressure” from trade creditors and subcontractors, to whom it owed about £12m. The wider group also owed £8.5m to two secured creditors – the Bank of London and the Middle East, and Close Leasing/Asset Finance. The document says “cash flow became increasingly constricted” as a result of these growing pressures, and ultimately became “extremely constrained”, with PCHC reliant on support from “other entities within the group”. In response, the document states the directors spent the first three months of 2015 exploring “various restructuring and refinancing options for the group as a whole”.

This included marketing its profitable crane hire arm, HTC - a sister company to PCHC - for sale in order to raise funds. To this end, Endless, which describes itself as a turnaround financing expert, was contacted as a potential buyer of HTC, with a sale anticipated to include PCHC’s fleet of 15 cranes, with a book value of £2.9m.

Amid market rumours PCHC was in difficulty, on 10 March 2014 accounts for PCHC, Crystal Formwork and a number of the other group companies were published. These showed the extent of PCHC’s losses, which PCHC described as “extremely disappointing” and which it blamed on delays suffered on two large contracts. But it also said its financial position remained strong with a “healthy” order book and that it continued to secure repeat business from satisfied clients.

More serious news was contained in notes to the accounts which started to give a fuller idea of the trouble PCHC was in. These pointed out that “the fact that cash flow commitments are starting to impact upon fellow group companies’ finances indicates the existence of a material uncertainty which may cast significant doubt on the company’s [PCHC’s] ability to continue as a going concern”. Nevertheless, the accounts said the directors were confident the company would meet day-to-day cash flow commitments, and said detailed sales and cash flow modelling had been provided until December 2015 to back this up.

Despite these assurances, by the end of March the view of the company had changed and group MD Duncan Salt called KPMG, alerting the firm to its difficulties. Obviously aware of where all these problems were leading, PCHC at some point before KPMG’s formal appointment also arranged the novation of two contracts - Sir Robert McAlpine’s Lillie Square scheme at Earls Court and Ballymore’s Royal Wharf project in east London - to a sister company in the group, Structural Systems. KPMG’s report says this was done “to attempt to protect the value in the contract debtors and protect the wider group from potential claims under performance bonds and parent company guarantees.”

Meanwhile, Endless decided not to buy HTC. However, the discussions led instead to Endless on 16 April refinancing all of the secured bank debt of PC Harrington Group, which by the time of KPMG’s appointment totalled £9.5m. The administrators’ proposals make clear that the upshot of this is that it is expected that the rest of the group will ultimately settle this bill - meaning this debt remains on the wider group despite PCHC’s subsequent fall into administration.

The PC Harrington Group at this time also found a buyer for HTC in German crane firm Wolffkran, with the sale including PCHC’s crane fleet. KPMG’s document shows that PCHC got £1.93m for the fleet - £1m less than the value for it registered on the group’s books, but the full market valuation at the time. However, the terms of the deal with Wolffkran means it has not yet given the group any cash for the business, and will not do so for up to six months. Instead, it has given the group “first legal charge” - in other words, right to the money from a sale - of three properties near the M1 between Sheffield and Rotherham as a form of guarantee the money will be forthcoming.

Despite this good news, on 15 April KPMG was formally engaged by the group “to help them explore the available options in the light of the group’s cash flow difficulties”. News of the difficulties finally broke in the press, when a court in Leeds registered this as a “notice of intention to appoint an administrator” to PCHC.

Despite this public admission of PCHC’s problems, the firm issued no comment, with Building’s journalists told to submit enquiries by post and wait for a response.

Internally it was becoming clearer by the day that nothing could be done to avoid administration, and the firm started winding down its trading operations in preparation. On 27 April the directors decided to appoint KPMG as administrator, and on 5 May Building broke the news after the notice was filed at Leeds Combined Court. Not previously reported is the fact that three days later the Harrington family-owned firm that supplied PCHC with labour - Crystal Formwork - and which employed at the last count 127 staff, was put into liquidation, owing HM Revenue and Customs £4.5m in PAYE and National Insurance Contributions, and £3.9m in VAT. According to a KPMG spokesperson, “the majority” of Crystal Formwork’s staff were transferred to Structural Systems prior to the appointment of liquidators, with the rest made redundant. However, PCHC’s only subsidiary - Slipform International - and all the other firms in the group continue to trade.

KPMG’s report, based on discussions with directors, KPMG agents, and any money still coming in, makes clear how dire the situation had got - albeit a more comprehensive “statement of affairs” had not been made public as Building went to press. The report says PCHC went into administration with debts of £28.4m. Of this external trade creditors and suppliers were owed £11.9m, with steel reinforcement supplier BRC owed £2.1m and LaFarge Tarmac £2.5m. The good news for suppliers is that because the bank debt was essentially taken on by the group, and PCHC employed no staff, the firm has no secured or preferential creditors, meaning all its assets can be distributed among the suppliers. However, just £900 was in the company’s two bank accounts when KPMG took control.

While the company in theory has assets – including debts owed to it – totalling more than its debts, having gone into administration KPMG’s initial estimate is that just £3m of these assets will actually be recoverable. Creditors, therefore, are likely to receive just a small share of what they are owed.

So what happens to the firm now? The directors of PCHC missed a deadline to provide to KPMG a more detailed financial picture of the firm, originally due by 26 May. However, this is expected to have been provided by the time of today’s creditors’ meeting, so more information may quickly become available. KPMG will look to sell Slipform, according to the administrator’s proposals, which has in the last year been attempting to take on customers outside of the PCH group. The KPMG spokesperson confirmed the administrators were “in discussion with the board and management team of Slipform International … which is expected to be marketed for sale in due course.” Overall the report simply says KPMG will seek a better outcome for the company’s creditors than would be likely if it were wound up.

KPMG’s administrators proposals says the firm is “together with our agents […] in the process of reviewing” whether the novation of two contracts to Structural Systems prior to the administration had meant PCHC “inadvertently suffered any loss or missed out on any profit”. A spokesperson for KPMG added: “As a matter of course, the joint administrators will always review the transfer and novation of contracts throughout an administration process to ensure that they provide the best value for creditors.” In addition, given the references in KPMG’s administrator’s proposals to the “group’s cash flow difficulties”, and the £9.5m group debt to Endless, it seems likely the group faces a tough time ahead. PC Harrington declined to comment on this article.

Personnel changes

There have been some big changes to the key names at the top of the PC Harrington Group in the last few months. According to Companies House the directorship of Vincent McLoughlin, a director within the group since 2000, was terminated at a number of group firms including PCHC, its holding company, Crystal Formwork and Slipform International around the time of the administration. Andrew Wood also left his position as a director at a number of group firms including PCHC, its holding company and Slipform in March. Most notable perhaps is the termination of the directorships of Pat Harrington’s son, also called Patrick, but known in the industry as PJ. He left his directorships at group firms including PCHC, Slipform and Crystal Formwork on 9 April.

No comments yet