Office occupiers and their employees are demanding space that supports new, more efficient ways of working, with a range of environments within a building tailored to different activities. What are the implications for workplace design and fit-out? Martin Kellett and Nicola Gillen of Aecom explain

01 / Introduction

Although Brexit continues to cast its shadow over the longer-term future of the real estate sector, trends in commercial office fit-out keep evolving. Developers and clients want to get the most out of space. Workers want a more flexible way of doing things, with offices that support collaboration and allow them to share information wherever they are – whether that is inside or indeed outside the building.

This means that concepts of “agile” or “activity-based” working – where an office provides a range of environments tailored to different kinds of work – are becoming a reality. In these spaces, formal and informal meeting rooms are mixed with quieter areas. Amenities such as cafes allow a diverse workforce to meet and socialise. Offices are becoming communities, with co-location of different teams or even companies driving new ideas and collaboration.

Aecom produced its first cost model on activity-based working in 2014. Since then the idea has gathered momentum, with the concept becoming more mainstream and becoming the starting point from which workplace strategies and office layouts are generated.

02 / Market transition from category A to activity-based space

The Q2 real estate data for 2017 demonstrates how agile, activity-based working is becoming more mainstream in the office market. Cushman & Wakefield reports that office-as-a-service (OaaS) providers accounted for the largest share of space leased in central London in the quarter at 28%, proof that we are observing a sea change in the way we work. Overall, OaaS was second only to technology, media and telecommunications in terms of space secured in the quarter.

While corporate clients in other sectors are more cautious than those in the OaaS sector when it comes to expansion – a result, probably, of the ongoing post-EU referendum uncertainty – many are adopting activity-based working principles to drive efficiency and productivity.

Corporates and central government are consolidating large, fragmented estates into fewer locations, leading to lower operational costs, reinforced identity and greater collaboration within the business.

Some major companies also are seeing benefits of extracting teams from their own corporate environments. A significant number of corporate occupiers have hived off teams and located them in a co-working space such as WeWork. This is particularly prevalent with innovation teams who are seeking to distance themselves from corporate bureaucracy.

The move to consolidate dispersed real estate portfolios has led to an increase of “grey space” on the market, as corporations vacate and move to large hubs.

In Q2, 9.4 million ft2 of this secondhand office space was available for rent in central London, perhaps masking the shortfall of new space being released. As these spaces free up, landlords kick off projects to bring them back to Category A (basic landlord fit-out) in preparation for marketing. Some are questioning the wisdom of this traditional Category A installation, instead taking the opportunity to make their space more contemporary and marketable.

This is hardly a controversial move. Back in the mid-1980s and 1990s the norm was to not install Category A fit-out at all. But as the market became more heated, agents started to provide Category A as a differentiator and specifications were stepped up to give tenants a sense of pride in their surroundings.

While this was understandable when the market was bullish, tenants now have a different agenda. They want more say in their environment and more social space. They have greater sustainability expectations and they want to attract the right staff, who are also more aware of these issues. They want activity-based working, or something like it.

03 / The shape of things to come

Developers are becoming more aligned with the requirements of an activity-based workplace and the infrastructure required to maximise its potential. With the wisdom of Category A under debate and a growing expectation for activity-based workplaces among clients and workforces, there are implications for landlords and tenants to consider.

- Should new and refurbished office spaces be offered as mostly shell and core, with a marketing suite to show options for finishes, systems and specifications? Shell and core buildings themselves are incorporating additional features to complement the agile ethos, for example using reception areas to create public spaces. Derwent London has rolled this out at the White Chapel Building, with the reception being specifically designed as a space open to the public.

- There may also be a shift to branded offices, offering a distinct base product for specific market sectors. Different tenant sectors require a different look and feel, so there will be less demand for standard Category A fit-out.

Activity-based working: the new normal

From being almost a wholly economics-driven concept in the 1990s – seeking principally to eliminate overcapacity, reduce space requirements and cut real estate costs – the idea of activity-based working has broadened as it has grown in popularity.

As millennials come of age, the flexibility and sense of community that activity-based working provides has become an expectation for the workplace, rather than a privilege for certain teams or tiers of management.

Initially, the lack of activity-based working schemes meant that workplace strategists struggled to demonstrate its benefits with hard data. This was compounded by the fact that workplace measurement was often not included in capital budgets, making it difficult for clients to source funding for post-occupancy studies. In addition, the benefits of activity-based working are easy to measure from a real estate perspective but harder to quantify in terms of people and productivity.

As more projects have been rolled out, driven initially by the economic advantages of being able to fit more people into a smaller space, occupiers can now see the positive effects for themselves. This is complemented by positive user feedback that demonstrates the wider, non-financial benefits of a forward-thinking workplace strategy.

Clients should still proceed with caution in some areas. Research by workplace performance consultant Leesman published in February 2017 found that activity-based working has been shown to be less effective for teams undertaking less complex tasks that do not require a high level of mobility in an office environment.

Even in environments where activity-based working is appropriate, employee inertia may prevent increases in productivity. Employees should be educated in the required behaviours and resultant benefits from agile working, backed up with solid processes and management leadership.

A building alone will not change behaviour or drive productivity. Information technology is a critical enabler of activity-based working, as is change management. If people are dropped into a new environment with no training, they will behave as they did before. Preparing people for the space is just as important as preparing the space for the people.

Francesca Jack, a director of Aecom’s workplace strategy team, agrees: “Having a robust and flexible change management plan with a carefully thought-out programme of engagement activities can really help capture the hearts and minds of employees and therefore help an employee adopt new ways of working and new behaviours more quickly, building organisational resilience throughout the project life cycle.”

Change management and employee engagement will be critical for the successful transition to these new ways of working. Aecom believes the future will see real estate strategy more closely aligned with corporate HR functions, such is the importance of the working environment in terms of attraction and retention of staff.

04 / Case study: Aecom at Aldgate Tower

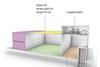

Aecom’s new UK headquarters, at Aldgate Tower in east London (from which the images on these pages are taken), is an example of activity-based working in action. The company used the move from its old base in the West End to rethink ideas of what a head office could be and how to energise its workers.

The design strategy designated 50% of the space as collaborative, to foster interaction and informal meetings. There are touchdown and break-out spaces, plus quiet working areas. Internal accommodation stairs complement the usual lifts and escape stairs, encouraging networking. Agile working protocols mean desks are shared by a team, with 25% of them “sit-stand”. Unified communications have replaced desk phones and terminals with laptops, smartphones and pervasive wi-fi.

Extensive research, employee engagement and training accompanied the move, which has resulted in the highest utilisation rate of all Aecom’s UK offices. Staff attrition has more than halved in the year since Aecom moved in. Feedback from teams throughout the building has been positive, with employees noting that the new workplace has increased productivity and collaboration.

05 / Design

Audiovisual installations

Technology is an important driver of activity-based working. Without an IT infrastructure that enables people to share information and communicate wherever they are in the building, new ways of working may struggle to gain traction.Getting the audiovisual (AV) installation right is critical, as it is these tools that allow collaboration in both formal and informal settings – indeed, some AV solutions such as Steelcase’s Mediascape, or Ahrend’s Balance system, have almost become default work settings. Minor outages in support systems such as wi-fi or room booking systems may lead to a loss of faith in the workplace strategy. Networks and equipment must be robust.

Audiovisual is becoming one of the largest packages in terms of the percentage of overall cost of measured works and is certainly an important critical path consideration. Greater use of larger screens has led to the adjustment of plasterboard specifications to include pattressing, with up to 18mm of plywood being incorporated into the partition.

This, together with the requirement for data, power and containment, means the AV package is a key part of the sequence at the design stage. AV equipment is also getting less expensive, replacing some of the more cumbersome AV solutions previously seen as mission-critical, such as telepresence and early video conferencing. Similar results can now be achieved at a much lower cost.

Clients are becoming more pragmatic in the selection and functionality of AV systems, allowing cost-effective solutions for everyday small collaborative areas. Cost drivers in this area include the size and specification of screens, wireless connections, functionality (such as Barco ClickShare) and bespoke integration with joinery.

And because the incorporation of AV allows office workers to collaborate more easily, companies can reduce the number of fixed workstations installed and move the space towards a better balance between collaborative and individual workspaces.

Integrated network systems

Another recent trend is a move towards integrated network systems (INS), which put all systems on one common data network. INS enables data from all building systems to be viewed at the same time and analytics to be carried out in one environment. This “single pane of glass” makes life easier for building managers, while helping them improve building performance through analysing trends and usage. Systems can be fine tuned to optimise sustainability and efficiency.

INS requires the building’s data network to be installed and commissioned much earlier in the fit-out programme. It also means the role of the fit-out team changes, from one that is relatively isolated and removed from the critical path to one that is fundamental to the build sequencing. IT rooms must be completed and handed over much earlier in the programme. More complex commissioning means that one central party should co-ordinate the exercise and the whole installation requires a new level of collaboration between trades.

INS does have some challenges to overcome. All building systems must have open protocols to enable communication and, unless all services agree to this principle, the value of INS becomes diminished. Lift manufacturers, for example, are wary of the safety implications inherent in their equipment potentially being controlled from a third-party system.

INS capital cost savings are predicated on the assumption that the building’s data network is already in place and that INS is merely making more efficient use of an existing installation. However, corporate IT networks are highly sensitive. The idea of third-party users and equipment being plugged into the same data network, carrying highly sensitive corporate data, will often be anathema to in-house IT specialists. This can lead to separate networks being installed, physically removed from the business-critical networks, compromising the argument that INS can save capital cost.

Security considerations

When accessing a data network – whether for an INS or AV system – security must be the prime concern. Room booking systems, which have become one of the key pieces of AV tech for activity-based working, can unwittingly provide a back door into the corporate network, potentially exposing HR data.

It is therefore essential that both factory acceptance testing and penetration testing – processes to ensure compliance with specification, and resistance to exploitation of systemic vulnerabilities – are undertaken in good time and are complete before on-site installation. This requires close collaboration between the design team, contractor and client IT representatives.

The need for security can also make integrating the shell and core and Category B (client-specific) fit-out problematic. Ideally the whole building should communicate and be visible on that single pane of glass. But companies in multi-tenanted buildings are reluctant to open the virtual door to those outside the organisation. And firm-wide preferred suppliers for the building management system or security used in the Category B fit-out may not be compatible with the landlord systems, even if the corporate security issues are resolved.

Getting closer

Nevertheless, there is a clear movement towards making integrated systems a reality. Projects such as the Bloomberg headquarters and UBS’s 5 Broadgate scheme have woven INS into their buildings with great success.

As the benefits of INS become more tangible and reportable and systems become cheaper and more commonplace, we believe we will see uptake increase. Fully intelligent buildings, including innovations such as Power over Ethernet, are, however, still some way off, with capital costs currently not being outweighed by the operational savings.

Equipment rooms

With greater uptake of off-site data centres and virtual dedicated server (VDS) technology, there is a trend for main and satellite equipment rooms to become smaller, with fewer data cabinets required on site. This has also led to a reduction in the amount or duty of the mechanical and electrical systems required to service the rooms, and the in-situ resilience requirements.

Pervasive wi-fi is more commonplace now but, despite being another enabler of activity-based working, it does not lead automatically to less data cabling. Clients still tend to err on the side of caution, preferring Ethernet connections to ensure business continuity.

Architectural impacts

In terms of architectural packages, activity-based working can lead to additional costs, as specialist joinery is required to make attractive “destination spaces” in the building. These costs can be mitigated by repetition on floors and by selecting proprietary furniture solutions rather than bespoke pieces, but specialist joinery can nevertheless represent a very significant portion of the construction costs of a fit-out.

Interconnectivity between floors can help foster a collaborative environment, with retrofitted staircases becoming more popular to encourage the vertical movement of people. These features will need structural works to form the openings, and can potentially require enclosure in fire-rated materials or the installation of smoke curtains.

The nature of these works will have a potentially disruptive effect on the construction programme. Often the structural openings for the staircases are formed as part of an enabling works package, prior to the full commencement of the works.

06 / Wellness

While buildings traditionally provide comfort and protection from external threats, we are discovering health risks associated with our internal environments. As people are now spending 90% of their time indoors, it is evident that we must design, construct, and operate buildings that are both sustainable and healthy.

While it is important that organisations become more environmentally friendly, the major cost inside buildings is the cost of employing people (the bulk of typical business operating costs are related to staff costs and salaries). It follows that the health and productivity of staff will be the primary focus for most organisations.

This focus drives consideration of improvements to the physical space but also goes deeper to explore how wellbeing permeates organisational culture, through policies such as talent strategies, total reward plans and employer relations. Wellbeing is a complex idea that requires a multidisciplinary approach and intervention throughout the organisation.

The criteria in new standards such as WELL certification have shifted the definition of good practice, which also means that occupants will adopt a new baseline expectation.

The increasing availability of affordable monitoring equipment and wearable technology allows occupants to be aware of their internal environments and empowers them to challenge organisations on the quality of internal spaces, in addition to taking personal steps to tracking movement and diet and limiting screen time.

The challenge will be to ensure that the larger wellbeing principles are embraced by the market to become standard best practice and inclusive for all – not merely for a lucky few who can live and work in healthy and sustainable buildings and communities.

07 / Procurement and construction

Currently, clients seem to prefer a more contractor-led design for commercial office fit-out projects, as opposed to the arguably more collaborative two-stage procurement process. Contractors are frequently being asked to tender on a single-stage design and build basis, with many risks being transferred to them – a situation often rather inelegantly termed “design and dump”.

Clients need to understand the implications of this form of procurement for fit-out projects, which are fast-moving and prone to change in line with business requirements. The current market may mean that contractors are prepared to entertain a single-stage procurement route which transfers design and construction risk. It is inevitable that this risk will be priced and that changes while on site will therefore come at a premium.

The shift towards large, rationalised headquarters favours the larger fit-out contractors, as procurement usually follows a framework model, particularly for public sector projects. As these large projects reach the regions, supply chains may need to be reviewed, with the limitations in capacity balanced against the importance of sustaining the local economy.

That said, the subcontractor market is generally operating within capacity, with the notable exceptions being joinery and building services – with particular pricing volatility in building management systems. Audiovisual packages are growing in value, and we do see this market being sensitive to fluctuations in supply and demand.

08 / About the cost model

This cost model is based on a notional fit-out for a total population of 1,500 full-time equivalent employees, using a sharing ratio of 80%. Using these variables, the following space budget can be generated, using a fit-factor of 5% and a circulation factor of 18%.

The costs assume the fit-out from a new developer-built office building fitted out to Category A standard, with the tenant using the building reception to receive and process visitors. Allowance has been made for an accommodation staircase to be included as part of the Category B fit-out. The cost model assumes that the procurement will be by means of a two-stage traditional process, with some elements being contractor designed.

We have assumed an eight-week pre-construction period during which the trade packages would be procured, followed by a two-week site mobilisation phase and 26 week fit-out programme, with IT rooms being handed over to the client prior to practical completion.

| Workstations and on-floor support | |

|---|---|

| Workstations | 6,689m² |

| Personal lockers | 155m² |

| Filing (three high) | 310m² |

| On-floor meeting rooms | 703m² |

| Open meeting spaces | 301m² |

| Touchdown | 401m² |

| Small collaboration spaces | 251m² |

| Team collaboration areas | 477m² |

| Large collaboration areas | 452m² |

| Breakout areas | 100m² |

| Coat cupboards | 134m² |

| Relax area | 201m² |

| Copy/print/refreshment points | 251m² |

| Total workstations and on-floor support | 10,425m² |

| Central support space | |

|---|---|

| Reception/lounge | 260m² |

| Central conference space | 549m² |

| Store rooms | 447m² |

| IT equipment rooms | 273m² |

| Contemplation/first-aid room | 67m² |

| Conference room pantry | 34m² |

| Post room/security | 126m² |

| Total central support | 1,756m² |

| Total net internal area | 12,181m² |

09 / Cost model

| Item | Total (£) | £/m2 | % |

|---|---|---|---|

| Structural alterations/builders’ work | 122,000 | 10.02 | 0.80 |

| Form openings for accommodation staircase including scaffold and crash deck; minor strip-out works | |||

| Raised access floors | 244,000 | 20.03 | 1.60 |

| Assume existing raised floor; take up and replace to allow access to floor void; cut in areas of slab-to-slab partitions; replacement tiles and pedestals; anti-static raised floor to computer rooms; GIFA floor to areas of hard floor finishes | |||

| Suspended ceilings | 366,000 | 30.05 | 2.41 |

| Assume existing perforated metal tile suspended ceiling with plasterboard margin; take down for access and reinstall; replacement tiles; trims; feature ceilings to collaboration/conferencing areas; remove Category A ceilings to computer rooms; assume no works to landlord areas eg toilets and lift lobbies | |||

| Partitions (drywall) | 975,000 | 80.04 | 6.41 |

| New partitions to form proposed layout; all meeting rooms to be slab-to-slab partitioning; allowance for plywood patressing to walls for AV screens; fire-rated walls to computer rooms; acoustic baffles above glazed partitions; fire stopping generally | |||

| Glazed/system partitions | 147,000 | 12.07 | 0.97 |

| 12.8mm single-glazed partition system to meeting rooms including glazed doors, abutments and ironmongery; manifestation. Acoustic rating RW38dB. Lift lobby doorsets, assume two per floor | |||

| Moveable walls | 61,000 | 5.01 | 0.40 |

| Allowance for moveable walls to form collaboration/presentation spaces; assume three, approx 5m long; 55dB; magnetic writable finish including ceiling baffle | |||

| Floor finishes | 366,000 | 30.05 | 2.41 |

| Medium-quality carpet tiles generally; timber floor to break-out areas; protection until completion | |||

| Stone and ceramics | 61,000 | 5.01 | 0.40 |

| Tiling to splashbacks in break-out areas; allowance for stone floor to concierge area | |||

| Decorations | 159,000 | 13.05 | 1.05 |

| Emulsion paint to new and existing walls and ceilings/margins; eggshell finish to existing basebuild timber doors; magnetic paint to one wall in meeting rooms; paint to skirtings | |||

| Joinery and ironmongery | 1,828,000 | 150.07 | 12.02 |

| Acoustic panelling to meeting rooms generally; bespoke furniture, banquette seating; locker units; touchdown desks; break-out area catering installations; credenzas to client meeting rooms; wall cladding to client meeting rooms; white goods to tea points, concierge reception desk; timber doorsets | |||

| Signage | 98,000 | 8.05 | 0.64 |

| Statutory, wayfinding and corporate signage and graphics. | |||

| Architectural metalwork/staircase | 232,000 | 19.05 | 1.53 |

| Design, manufacture, supply and install staircases. Straight-flight, closed-tread mild steel accommodation staircase to connect floors; vinyl to treads and risers; low-iron heat-soaked toughened glass balusters, steel handrail. Finished with 20% gloss cellulose system | |||

| Blinds | 134,000 | 11.00 | 0.88 |

| Manual glare blinds generally; dim-out blinds to conference rooms | |||

| Mechanical installations | 2,132,000 | 175.03 | 14.02 |

| Validation of existing systems; amend/extend Category A installations to suit proposed layout; modification/extension of primary and secondary ductwork; air-conditioning units to computer rooms including chilled water and condensate pipework; water and disposal installations to cafe areas and cleaners’ cupboards; dedicated extract to cafe; air-handling units and supporting DX system to conference area; relocation of services to enable construction of accommodation staircase | |||

| Electrical installations | 2,680,000 | 220.01 | 17.62 |

| Validation of existing systems; retain existing Category A lighting installation; specialist lighting to collaboration areas; feature lighting to meeting rooms; scene setting; relocation of services to enable construction of accommodation staircase. Power to mechanical installations; new tenant distribution boards; small-power, underfloor power distribution; UPS to main equipment room. Containment for data and LV installations; harmonics testing | |||

| Fire alarms | 366,000 | 30.05 | 2.41 |

| Reconfigure fire alarm and public address installations to suit proposed layout; very-early smoke detection apparatus and gas suppression to computer rooms | |||

| Sprinklers | 244,000 | 20.03 | 1.60 |

| Relocate sprinklers to suit proposed layout; extend/modify existing sprinkler installation to comply with regulations; pre-action sprinkler to computer rooms; drain down sprinkler system during works as required; refill, test and commission. Excludes void protection | |||

| Building management system | 488,000 | 40.06 | 3.21 |

| New controllers and field wiring; new head end and software; metering of lighting and power; monitoring of new infrastructure plant; motor control centre panel | |||

| Audiovisual | 439,000 | 36.04 | 2.89 |

| AV installations to meeting rooms, reception breakout and collaboration areas; wireless connections; TV distribution system; meeting room booking system including booking panels; dual-screen video conference | |||

| Security | 122,000 | 10.02 | 0.80 |

| Card readers to entrance doors on each floor, computer room, secure storage, CCTV cameras | |||

| Structured cabling | 305,000 | 25.04 | 2.01 |

| Wireless access points, fibre backbone, Category 6E cabling, cable matting, patch leads, cabinets and power strips to computer rooms | |||

| Main contractor’s fee | 232,000 | 19.05 | 1.53 |

| Fee of 2% on total measured works package values | |||

| Main contractor preliminaries | 610,000 | 50.08 | 4.01 |

| Pre-construction fee (£80,000), assume eight-week pre-construction period; 26-week on-site construction period plus two week mobilisation; assume one move of site set-up to allow completion of the works | |||

| SUB-TOTAL CONSTRUCTION | 12,411,000 | 1,018.88 | 81.62 |

| Furniture | 2,071,000 | 170.02 | 13.62 |

| Bench workstations with 2x power and 2x data presented at desktop; dual monitor arm; 30% sit-stand desks. Cafe seating to kitchen areas; furniture to collaboration areas including some soft seating; soft seating to concierge/on-floor reception area; flexible tables to conference rooms; allowance of one personal locker per full-time employee | |||

| Contingency | 724,000 | 59.44 | 4.76 |

| Design reserve allowance of 5% of construction and furniture costs | |||

| TOTAL INCLUDING FURNITURE AND CONTINGENCY | 15,206,000 | 1,248.34 | 100.00 |

Downloads

Cost model office fit out nov2017

Excel, Size 22.19 kb

Postscript

Acknowledgement: James Game of Divers Managed Solutions

No comments yet