The latest survey of top architecture firms for Building’s sister title Building Design shows a global uplift in sentiment, with the Middle East leading the way and cautious optimism on India, writes David Blackman

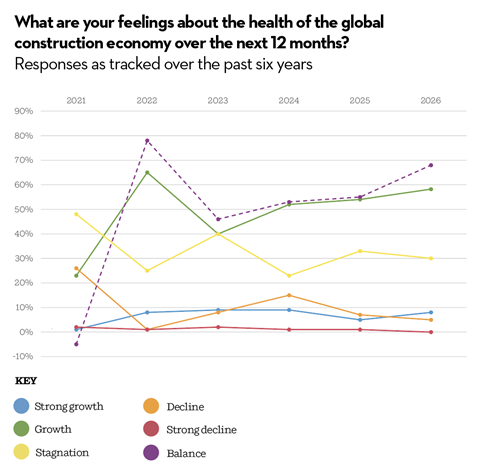

The good news for architects worldwide is that sentiment about the global construction economy has improved among respondents to the annual WA100 survey for Building’s sister title Building Design, which was published last week.

Just under two-thirds (65%) believe 2026 will see growth, with 8% expecting this expansion to be strong. This is an improvement on last year’s finding that 59% expected growth in 2025, making it the most positive sentiment since 2022’s post-covid rebound.

The proportion anticipating stagnation has fallen to 30%, compared with 33% last year. And those expecting a decline in the construction market worldwide have decreased from 8% to 5%.

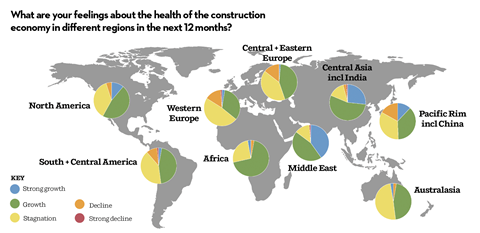

Helping to fuel this more confident outlook are improved growth expectations in the global economy’s core regions of North America and the Pacific Rim.

The proportion of respondents expecting growth in North America has risen from 53% last year to 57%, although the share of those anticipating stagnation has remained steady at 38%.

Confidence in the Pacific Rim, which is centred on China, has seen a rebound with just under half (49%) anticipating growth in 2026, up from last year’s figure of 41%.

The brightest spot for architects, like last year, is the arc of countries running through India from the Middle East to Central Asia. Confidence in the WA100’s Middle East and Central Asia regions is even stronger than in 2025’s survey. The proportion of architects who feel that the Middle East construction market will grow in 2026 has climbed to 85%, with just 1% forecasting decline. Nearly half of those expecting growth in the region expect it will be strong. And the Central Asia region is not far behind, with 81% of those surveyed expecting its construction market will grow in 2026.

Western Europe remains the region that WA100 respondents are least confident about, with barely a third feeling its construction market will grow in 2026, a lower proportion than last year’s 40%.

US markets are good in parts

Elizabeth Brink, co-CEO of Gensler, says that while some US markets remain “pretty sluggish”, there is a lot of activity from financial services and technology clients across the US’s major centres.

Sarah Kay, CEO of Australian architect Woods Bagot, says that while there is much variation across North American markets, the tech boom on the US West Coast is “insane”, as is growth in the country’s aviation sector.

Steve McKay, chief executive of Seattle-headquartered DLR Group, says that the “smile of the US” – the arc running around the country’s east and west coasts via the southern states – is still “very busy”.

There’s still a lot of potential domestically for us [in the US]

Doug Wignall, HDR

Even Detroit, long a byword for urban decay, is “back on the map”, he says. “As a city it’s gone through two decades of challenge but now it is bubbling. There’s still a lot of potential domestically for us.”

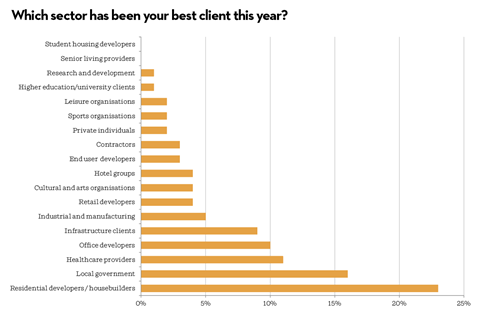

However, Doug Wignall, president of US-headquartered HDR, says that while the areas his firm specialises in – like healthcare and life sciences – are booming, those working in commercial and retail will probably tell a “radically different” tale.

As Phil Harrison, CEO of Perkins&Will, says: “Our industry tends to be a bellwether for general economic confidence and optimism about the future.”

The small rise in architects’ growth expectations for North America betrays how confidence remains a “little bit shaky”, with the trade war between the US and Canada already depressing the latter country’s economy, he says.

And the recently concluded federal government shutdown in the US means many public clients were not even at their desks for more than a month, Harrison says.

>> Also read: Fosters back as UK’s biggest architect and breaks into top 20 of world’s largest practices

This is one of the reasons why clients have been moving “more slowly than normal”, resulting in large backlogs of work, he says. “It used to be you would be selected for a project, it would take a month or two to get through contract negotiations and firm up the work plan, and then you would get to work. These days that one to two months has become six to 12 months, and that’s the new normal. The result is we’re typically carrying about three or four or five months of additional backlog on our books. That’s work under contract, not yet committed.

“That’s nice, and we like to know that the work is there – and it makes our businesses easier to manage because we can predict the work that will be happening, especially once it starts moving. On the other hand, the vulnerability for any business is if these projects go on hold again or are cancelled altogether.”

Awaiting China’s reawakening

While the WA100 survey shows signs of resurging confidence in the Pacific Rim construction market, the chief executives of big architecture practice are less bullish about China.

Keith Griffiths, chair of Hong Kong-headquartered Aedas, says a recent meeting of the firm’s mainland China directors and business development executives concluded that they expect less work in the country next year.

There’s a bunch of points in [china’s] next five‑year plan, and recovering a property market is not one

Keith Griffiths, Aedas

The Chinese government’s next five-year plan doesn’t mention state aid to the property market and is instead focused on strengthening the country’s position in value-added technology industries, like electric cars and batteries, he says. “There’s a bunch of points in the next five-year plan, and recovering a property market is not one.

“There’s little or no construction activity in mainland China,” he says, adding that the country has already got more airports, railways and shopping centres than it needs, meaning there is “no point” building more.

Around a third of the company’s work is still in China, including Hong Kong. However, Aedas has expanded into new markets, like the Mongolian capital Ulaanbaatar and the Central Asian republics, to keep the company’s staff in mainland China busy, he says.

The continued stagnation of the Chinese market means Griffiths doesn’t see many US architects going back into that market.

Kay agrees. “It [the Chinese market] is not booming and it’s a lot more localised. There’s a huge amount of local talent, so there’s less call for the internationals coming in.” HDR has largely run down its Chinese office, admits Wignall.

But there are exceptions, such as Foster + Partners, which still has “a lot of work” in China, says Griffiths. Stuart Latham, managing partner at Fosters, says he is aware of some of the larger US practices withdrawing from China but has no plans to follow them.

There’s no question that the [chinese] economy is still a little soft, but there’s work there

Steve McKay, DLR

“We have got a lot of Chinese nationals that have all been decades in London who have returned home and understand our way of working and our culture,” he says. “We don’t want to close those offices. We believe that market is strengthening, and we want to stay there. We’ve made mistakes by coming home in the past. We have to show loyalty to these markets, and these markets will show loyalty to us.”

DLR’s McKay is keen too to retain a foothold in China, pointing to the “good run” of projects that the company has had in the country, including several that have opened over the last year. “There’s no question that the economy is still a little soft, but there’s work there,” he says, pointing to the culture sector as a growth area for the company.

Much of the inward investment pulled out of China has gone into Australia and South East Asia, which are “doing really well”, says Griffiths. Aedas has rebalanced its work pipeline, with around a third now being in each of the Middle East and South East Asia regions.

However, developers across East Asia want lower-cost buildings, meaning there is “no demand for starchitects”, he says. “Developers have no excess funds to spend. They want practical buildings that are not going to attract high construction costs.” Even China’s local design institutes are seeking work outside the country, often on the coat-tails of Chinese contractors, Griffiths says: “You’ll find a lot of Chinese contractors in the Middle East, especially in Saudi, together with the local design institutes.”

Middle East still booming

And McKay says DLR’s Shanghai office is being “retooled” to support what is expected to be continued growth in the Middle East. This is partly because time differences between China and the Middle East are easier to manage than those with the US. In addition, Asian offices’ project teams have a “much clearer understanding” of Middle Eastern clients’ delivery requirements, he says.

This is part of a wider realignment of DLR’s non-US footprint, which is driven by the work that the architectural and engineering consultancy is picking up in the Middle East, not only in Saudi Arabia but in neighbouring countries, such as Egypt, the Gulf states and Iraq.

DLR may open a UK office to service three big Middle Eastern projects potentially in the pipeline, says McKay. “If they are successful, then they will require us to open a European office – and if we need people in Europe, those people will be in the UK.”

Fosters is a clear beneficiary of the “huge growth” being seen in the Middle Eastern and particularly Saudi Arabian construction markets, says Latham. The British company’s success winning a number of “very large, notable” design competitions in the Middle East has fuelled an increase in Fosters’ qualified architect headcount of nearly 200 over the last year, he says.

As well as the UAE’s Zayed National Museum, which opened at the beginning of December, the company’s other major projects in the region include Riyadh’s King Salman International Airport and Kuwait International Airport.

Perkins&Will and Woods Bagot are among the big international practices that have opened offices in Riyadh over the past year. The Saudi government is keen for architecture practices to set up offices in the country rather than have design professionals “fly in” every few months, says Harrison. “When you need them, you need them, and it’s better to have them in the corner.”

However, Griffiths says that even though his company is supporting architectural education in Saudi Arabia, there are still “not enough” trained architects to run full-blown offices in the country. And amid recent gloomy headlines about stuttering progress on the Saudi showpiece Neom project, he predicts that a number of companies will be “rapidly downsizing” their presence in the region.

Woods Bagot’s growth across the Middle East has rebalanced during 2025 from Saudi Arabia towards Abu Dhabi and Dubai, which are “really booming”, says Kay.

Firms moving into India

Big architecture firms are becoming less hesitant about opening up operations in India. Fosters is considering launching an office in India to serve the company’s project to build the new Amaravati government complex in the state capital of Andhra Pradesh, says Latham.

“No decisions have been made on India but we want to follow the work and to service our projects and support our clients,” he says. “Probably the best way to do that on these larger projects is to actually put a permanent presence in the country.”

And Brink says that Gensler, which already has offices in Bangalore and Mumbai, has opened a Delhi location during the past year in order to serve the work it is doing in the Indian capital with an “on-the-ground presence”.

But others remain more hesitant about expanding in India. While Perkins&Will does operate in the country, it has yet to build a significant practice there, says Harrison. “It’s a difficult market to work in relation to business practices and it tends to be a lower fee environment, so it’s hard to compete for us in that context. In time, I’m sure we will be in India: it’s just a matter of the right time to enter the market,” he says.

Aedas’s Griffiths says that the “incredibly low” fees on offer in India mean “it’s not a market that international companies can compete in”.

Mansoor Kazerouni, Arcadis’s global director of architecture and urbanism, says that while the multidisciplinary giant has a “sizable presence” in India, which he visited recently, the company remains “very cautious”.

“The kind of infrastructure projects you see there are enormous. They’re building roads and highways and bridges, subways and airports, all at the same time – so there’s a phenomenal amount of growth and opportunity. We continue to operate there but definitely are not going into that market super-aggressively.”

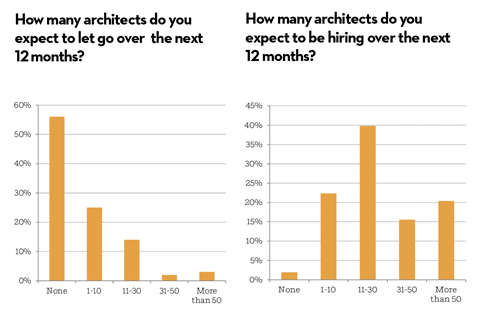

Practices’ recruitment plans echo the uplift in optimism

The generally bullish outlook of global architects on the sector’s growth prospects in the WA 100 survey is echoed by its findings on practices’ hiring and firing plans.

Only 2% of practices that responded to the recruitment section of the WA 100 survey said they don’t expect to hire any architects over the next 12 months, which is less than last year.

The most popular answer to this question, at 40% of respondents, was that practices expect to recruit 11-30 architects. And a fifth (20%) said they expect to hire more than 50 architects in the coming year.

A further sign of confidence is that more than half of practices surveyed (56%) said they expect to let no architects go over the next 12 months, which is a higher proportion than last year’s 46%. And 25% said they expect to fire between one and 10 architects, which is the same proportion as two years ago after rising to 37% in 2025’s survey.

Gensler CEO Elizabeth Brink says the world’s biggest practice will be hiring next year in key areas, where additional expertise is required, naming healthcare, data centres and aviation. In addition to hiring in these sectors, Gensler will be on the hunt for architects with skills in “advanced” tools and technologies”, reflecting the industry’s embrace of AI.

Perkins&Will CEO Phil Harrison says the nine-strong drop in the US practice’s qualified architect headcount to 886 mainly reflects some “hesitancy” about hiring combined with the “normal” attrition that any workforce experiences. “When we stop hiring, we shrink,” he says, adding that this dip is likely to reverse as projects pick up and additional architects come into the firm following recent mergers over coming months.

And despite the gloomy headlines about AI’s encroachment in the workplace, the architecture recruitment market remains tight, according to DLR Group CEO Steve McKay. “There’s not enough great folks in the A&E space,” he says.

Postscript

This article is taken from the 2026 edition of World Architecture 100, published by Building Design and free to subscribers.

Not yet a subscriber?

Subscribe to Building Design where not only will you get unlimited access to news, comment and advice but you’ll also have immediate access to the digital version of WA100.

Alternatively, you can purchase a copy of the WA100 in digital or print here.

No comments yet