The value of construction contracts awarded in the UK dropped to £5.8bn in November, with residential accounting for the highest proportion of contracts awarded by value. Here are highlights of Barbour ABI’s latest monthly Economic & Construction Market Review

Economic context

The main headlines for the UK economy this month were dominated by the Autumn Statement, which set out the government’s view on current economic performance. It was the last major spending announcement before the election period, which also set out the detail of tax and spending decisions over the next parliament up to 2020. In many ways it felt like the election battle lines were being drawn, with key reforms to income tax bands and the abolishment of the air passenger duty for children under 12, among others - all designed to appeal to the electorate. The biggest headline was the reforms to stamp duty land tax - abolishing the slab system and replacing it with progressive banding similar to income tax.

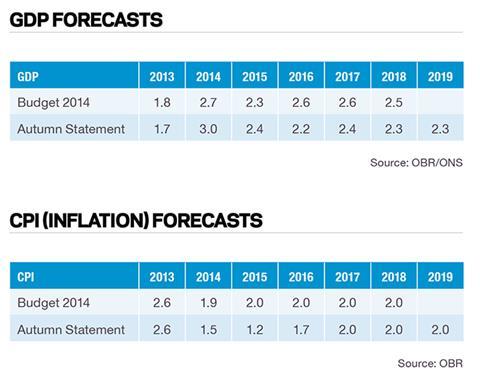

Within the Autumn Statement, the Office for Budget Responsibility (OBR) updated its economic forecasts for the UK in the upcoming years with its estimate for growth this year now at 3.0%, an increase from the 2.7% forecast in the Budget (see GDP Forecasts, right). The forecast for 2015 was also revised upwards with an estimate of 2.4% growth, an increase from the 2.3% figure in March. The OBR now think that growth will moderate to 2.2% in 2016 and 2.4% in 2017 and 2.3% beyond that.

Inflation forecasts were also reduced for 2014 from 1.9% to 1.5%, which is significantly below the target of 2.0% (see CPI Forecasts, right). The OBR’s inflation target of 2.0% is predicted to be met in 2017, two years later than the March Budget stated.

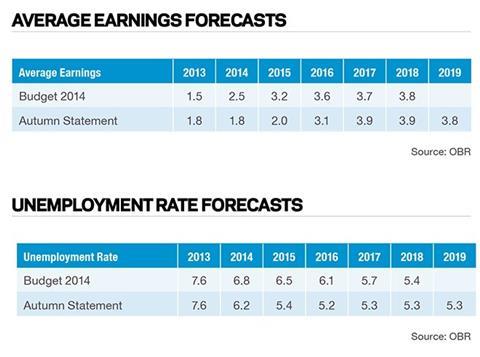

Average earnings continue to be challenged with the OBR revising its forecasts down to 1.8% wage growth this year, when it expected the figure to be 2.5% when the Budget was announced (see Average Earnings, right). Wages are therefore forecast to rise below the level of inflation this year although by next year this is predicted to change with average earnings forecast to be 2% while inflation is 1.2%.

Unemployment forecasts also improved in the Autumn Statement, reflecting the rapid fall in unemployment levels in recent months with an estimate of 6.2% this year, compared with 6.8% in the March Budget (see Unemployment Rate, right). Unemployment is set to fall to 5.2% in 2015 and settle at the long-term rate of 5.3% beyond that. These forecasts imply that inflation will be on target and unemployment will be at its natural level in 2017, indicating a healthy economy.

The many policy measures announced in the statement included:

- Series of announcements to boost the “Northern powerhouse” - a sovereign wealth fund will be set up for the North; a £78m new arts space named ‘The Factory’ will be built in Manchester

- Funding for lending scheme extended by a further year, with a focus on smaller firms

- Consultation on the operation of a number of tax structures - including umbrella companies - and whether they should be limited

- Expanded tax relief on flood defences

- £45m package for first-time exporters

- Commitment to extend the Cathedral Renovation Fund to extend repairs to churches across the country

- Fuel duty remains frozen

- £2bn extra each year for the NHS.

The CPA forecasts

The Markit/CIPS PMI survey for construction showed a fall in the headline level of activity in November. The latest figures show that the Construction PMI stands at 59.4, down from 61.4 in October. This is a 13-month low but is still the highest scoring sector in the entire UK economy. The outlook for construction remains positive with the latest forecasts for the industry from the Construction Products Association (CPA) continuing to show strong growth in the coming years. The CPA recently updated its forecasts for 2015 and beyond with the industry now predicted to grow by 4.8% this year and 5.8% next year, on the back of continuing strength in the new build residential sector and increasing activity in the commercial and infrastructure sectors. While this is welcome news for the industry, it is important to note that it will be 2016 before the industry exceeds the levels of activity occurring in 2007 before the recession took hold.

The construction sector

According to Barbour ABI data on all contract activity, November witnessed a decrease with the value of new contracts awarded £5.8bn, based on a three-month rolling average. This is a 3.4% decrease from October and a 4.4% decrease on the value recorded in November 2013. The number of construction projects within the UK in November decreased by 12.6% from October, and by 9.8% from November 2013.

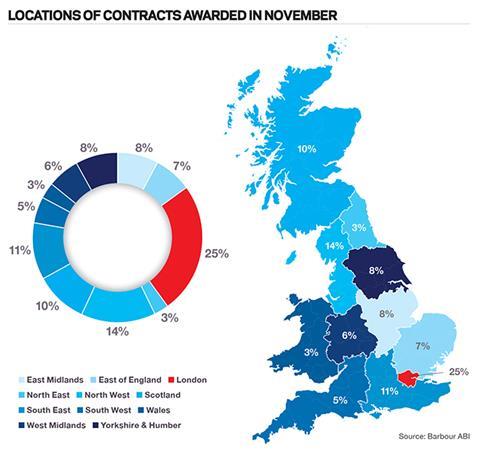

The majority of the contracts awarded in November by value were in London, accounting for 25% of the UK total (see Locations of Contracts Awarded, right). This is followed by the North-west with 14% of contracts awarded. The main reason for London’s dominance was the £200m Imperial College Research and Translation Hub. There was also a major residential project awarded at 250 City Road which is valued at £150m and set to deliver 995 residential units. In the North-west the Oldham wastewater treatment works upgrade valued at £80m and an industrial project in Cheshire called Omega South worth £68m accounted for the region’s high share of contracts awarded in November. Other contracts of note in November are the £180m energy-from-waste plant in Dunbar, and the deepwater berth at the Port of Hull valued at £100m.

Type of projects

Residential had the highest proportion of contracts awarded by value in November with 30% of the total. The infrastructure sector also featured prominently this month accounting for 22% of the total value of all projects and education accounted for 14%. This is an indication of the continuing strength of the residential sector within construction, although it is notable that the education sector continues to perform well after recent large contract awards.

Construction performance by sector: Spotlight on hotels, leisure and sport

The hotel, leisure and sport sector showed monthly increases in contract values in the three months to November and over the quarter values have also increased.

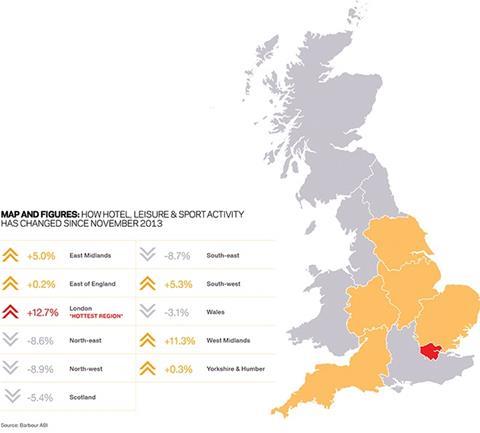

Contract award levels in the hotel, leisure and sport sector were £574m in November, based on a three-month rolling average. This was 8.8% higher than October and 34.3% higher than November 2013. In the three months to November the value of contracts was 41.5% higher than the previous three months. This was an increase of 16.1% compared to the same period in 2013, indicating a longer-term improvement in activity over the year.

London was the main location for hotel, leisure and sport contracts this month, accounting for 40% of the value awarded (see Map and Figures, below). This was principally due to the award of £100m contract to develop a luxury hotel at the site of the former Scotland Yard building in London. There was also a £40m contract to develop the Art’otel Hotel in Hoxton, east London, which boosted London’s performance in November.

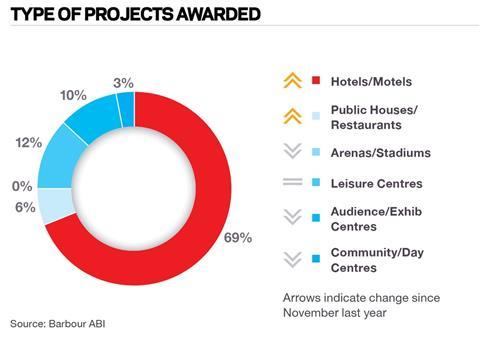

Due to the significant value of the Scotland Yard hotel project it is no surprise that the hotels/motels category is the main type of contract accounting for 69% of the value of contracts in November, a 28% change from the corresponding month in 2013 (see Type of Projects Awarded, below).

Click here for the full Economic & Construction Market Review >>

Downloads

ECMR December 2014

PDF, Size 0 kb

No comments yet