Housing and construction activity not affected by election uncertainty according to latest indices

For all the hype about housing and construction activity being affected by election uncertainty, it doesn’t appear to be the case, according to the latest CPA/Barbour ABI indices. Elections tend to have relatively little impact on the industry, as they generally happen around every five years and the private sector tends to just get on with working. Overall, construction activity tends to be affected more by the general economic environment; business investment and household spending. Given this, it’s no surprise to see that the CPA/Barbour ABI index in April, at 138, was 6% higher than in March and 10% higher than one year earlier. As the index measures construction contract awards, it suggests growth going forward over the next 12 months. However, given that we now have a new government with a clear majority, what will be interesting to see is whether they can deliver on key pledges regarding projects in the National Infrastructure Plan and particularly on housing.

Click here for all the latest Barometer data

Private housing index

Speeding up again

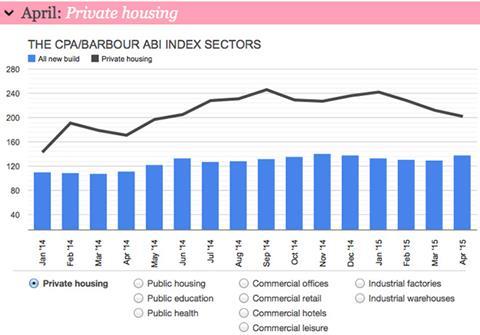

The CPA/Barbour ABI private housing index registered 202 in April, which was 4% higher than a year earlier, which is likely to ensure an increase in housebuilding this year compared to last year. However, private housing is one of the few sectors where election uncertainty may have had a significant impact, given that it was the sector that has received the most government support in recent years, with demand-focused policies such as help to buy. So, it was also the sector most likely to be subject to policy changes post-election.

Although the index was higher on an annual basis, it was also 5% lower than in March, suggesting a temporary slowdown due to election uncertainty. The election result was welcomed by housebuilders and the expected impact on the housing market could be seen the day after with significant rises in housebuilder share prices. Now, with the election out of the way, expect to see the private housing index rise again and we forecast starts this year will be 10% higher than a year earlier.

After that, growth will be dependent upon whether government can put in place policies to boost supply and not just demand.

Noble Francis is economics director at the Construction Products Association

No comments yet