The fourth article in the Steel Insight series focuses on the various factors to consider when cost planning a steel-framed multi-storey building

01 / INTRODUCTION

The first and second Steel Insight articles addressed the challenges of realistic cost estimating of structural steelwork through the design stages across a range of building forms and types. The third article used a more detailed study of two typical commercial buildings to explore not only the cost but also the programme and sustainability benefits of structural steel frame solutions.

This article begins a new series on cost factors for specific sectors and types of building with a focus on the cost planning of steel-framed multi-storey buildings. It builds on

the previous Steel Insight article guidance on the cost estimating and typical cost range for the structural steel frame of a multi-storey building by addressing in further depth the key cost drivers for this sector specifically. It also gives guidance to quantity surveyors as to where a particular proposed building may sit within the standard ranges during the cost estimating stages of a project.

02 / STEEL AND MULTI-STOREY CONSTRUCTION

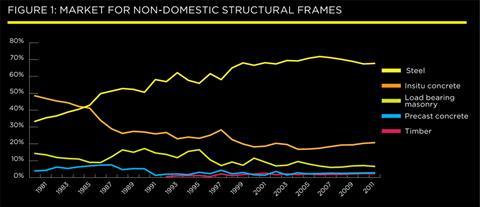

Multi-storey construction is a key sector for structural steelwork. The latest Construction Markets annual survey commissioned by BCSA and Tata Steel shows that in 2011 steel frames accounted for 67.7% of all non-domestic framed multi-storey construction in the UK (Figure 1) and for 69.4% of the multi-storey offices market, compared with a market share of 20.7% for in-situ concrete.

A key component of the cost of any building type is the frame, with the importance of this aspect of the cost increasing as buildings become taller.

As covered in previous articles, pressures on the design team during the development phase of the project may tend towards comparing comparative costs of different frame materials alone, but this is too simplistic. The frame design itself will also have an impact on the cost of associated building elements, such as the substructure and cladding, and also on speed of construction.

The importance of ensuring that the key frame cost drivers are understood, assessed and reflected in the design stage cost estimates cannot be underestimated.

03 / MULTI-STOREY VS TALL BUILDINGS

Multi-storey construction covers a range of building types, forms and functions; however it is possible to identify typical design and construction drivers that are common across the sector.

It is, however, important to make a distinction between ‘multi-storey’ and ‘tall’ buildings. Multi-storey typically describes buildings of between five and 15 storeys, whereas in the UK a building is likely to be considered tall when it exceeds 20 storeys. At this height and above, different factors become relevant which start to make these buildings technically different in design from those of a lower height.

This article firstly examines the characteristics and key cost drivers of typical multi-storey buildings and also considers the different drivers and constraints that apply to buildings over 20 storeys.

04 / TYPICAL CHARACTERISTICS OF MULTI-STOREY BUILDINGS (5-15 STOREYS)

Multi-storey buildings are a typical feature of city centre construction and principally of commercial buildings. They are often speculative office buildings which may also contain elements of retail space at lower levels, and a key client driver will be to maximise their appeal to a range of tenants and/or purchasers through the provision of flexible, attractive, open plan space and a good floor to ceiling height.

They are also constructed typically in a city centre or constrained site location, with party wall, rights of light and oversailing issues particular considerations, this impacts on the achievable building form during the design stages as well as directly on logistics and buildability during construction.

While guidance exists on standard cost ranges for the structural steel frame of multi-storey buildings, at the early design stages of a particular scheme it is important to consider a number of key aspects of the proposed design to determine where the building will sit within or even outside of these ranges to ensure that the cost reflects the specific building proposed.

As the design develops and the costing methodology progresses to quantifying and costing the specific building design rather than utilising typical cost ranges, these key cost drivers remain important both for ensuring that it is a realistic cost that is included within cost plans. It also enables the design team and client to understand how the specific factors of the building have influenced the structural frame cost for the proposed building in relation to typical or benchmarked schemes.

05 / KEY COST DRIVERS FOR MULTI-STOREY BUILDINGS (5-15 STOREYS)

Speculative developments in the commercial sector will typically be built without a specific tenant or purchaser involved in or influencing the design process. The resulting building will therefore need to be flexible to meet the needs of a range of tenants and also to provide attractive lettable space. Common characteristics of these buildings will be open-plan floor areas, maximised floor-to-ceiling heights and efficient services zones. These requirements directly impact on the configuration of the structural frame and the frame cost. Speed of construction will be important for the developer as it looks to generate a return on investment as quickly as possible.

• Structural grid and configuration

The structural grid will impact on the extent of open-plan lettable floor space and spans will typically fall into a range of between 6m and 16m, with over 12m spans being very common on commercial office schemes. At these longer spans, steel has significant benefits over other frame types which is illustrated by its greater market share on commercial schemes and cost competitiveness (Figure 4).

If the cost model considers only the physical steel cost (kg/m2 of steel) then longer spans could be viewed as attracting a cost premium as the weight of the steel frame per unit of floor area will be higher than for shorter spans. However, consideration should be given to the value benefits of increased open plan lettable space or the reduced construction programme that can be achieved with long span steel construction. Foundation costs can also often be lower due to fewer columns being required. As previous articles have illustrated, material cost is only one element of overall cost, so while a long span layout may have a higher overall frame weight, there may be efficiencies in other areas of the construction that can compensate for this.

• Non-standard sections

Where there is a particular requirement to limit the overall height of a building, shallow-floor steel systems can be used. These will tend to have a higher cost per unit area than a standard frame; however, this may be offset by associated savings from the lower building height and reduced cladding area.

Many multi-storey commercial buildings in the UK currently use long-span fabricated cellular beams, which allow for integration of the services through openings in the beams. This reduces the overall depth of the floor zone and increases flexibility in the building fit-out.

Cellular beams will tend to have a higher cost per tonne than a standard frame but the increased cost of fabrication is offset by the reduced weight of the section compared with other solutions for the same spans.

• Fire protection requirements

Fire protection typically accounts for around 10-15% of the overall steel frame cost in commercial multi-storey buildings, so the requirements and approach adopted can have a significant impact on how the cost of a particular building compares with others.

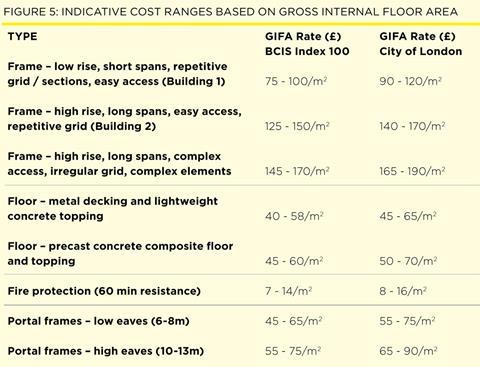

The typical fire rating for a multi-storey building varies from 60 minutes to 120 minutes plus sprinklers depending on the building height. The cost table (Figure 5) is based on a 60 minute fire rating, so if the rating for the proposed building varies from this then a corresponding adjustment will need to be made to the frame cost.

When reviewing the design and weight of the steel frame, it is also important to note that it can be cost-effective to consider using heavier steel sections to enable the volume and cost of fire protection materials to be reduced.

It may also be beneficial to carry out a specialist fire engineering study for complex buildings with onerous fire protection requirements. Specialist fire safety engineering involves a risk-based approach to design, which considers where the actual risks in fire are, rather than relying on the more simple guidance contained in the Building Regulations. This approach can lead to reduced fire ratings for some elements of the structure and therefore reduced costs of fire protection, without compromising safety.

• Site constraints and building form

Multi-storey buildings are often constructed on existing confined or irregular sites, which will influence the achievable building form. An irregular site may prevent the use of regular column grids throughout the floor plate and alterations to the configuration of floor plates on the upper storeys may be required to overcome rights of light or party wall constraints.

More repetitive structures will be more cost-efficient both in terms of fabrication and erection, so the extent to which a building will be influenced by factors that reduce the level of repetition needs to be assessed during cost planning. By gaining a greater understanding of the likely impact of the design on the construction programme, preliminaries allowances will also be better informed.

• Site constraints and logistics

Even where two multi-storey buildings have similar form, configuration and frame components, the logistics and access arrangements may vary significantly. The speed of delivery and erection and minimal site storage requirements are key benefits of a structural steelwork solution.

The erection of the steel frame typically accounts for around 10-15% of the total frame cost so at the cost planning stages consideration should be given to whether there are factors that could lead to restrictions on working hours, noise, deliveries, storage or craneage which may impact on the construction programme. As the frame construction is generally a critical path activity, an increase in the construction programme will have an associated impact on project cost.

06 / TALL BUILDINGS (20+ STOREYS)

As the height of a building increases and it becomes tall rather than just multi-storey, a number of factors become increasingly important that have a direct influence on the cost of construction.

As previously noted, in the UK a tall building is generally accepted to be a building which exceeds 20 storeys. At this height the requirements for the vertical transportation of occupants and services routes start to have an impact on the efficiency of the internal area and this continues to be a key factor as the building height increases.

While the key cost drivers for multi-storey buildings are still applicable when cost planning a tall building, other factors also begin to influence the design and construction. Maximising the cost efficiency of the structural frame has to compete with other key priorities in the design, such as providing spaces suitable for a mixed range of uses, which can drive changing grid configurations, the need for transfer structures, changing floor-to-floor heights and different acoustic requirements for each use.

The requirements for vertical transportation and service distribution strategies will also have a significant bearing on the approach to the design of the building cores.

Each tall building is unique and a prominent building wherever its location. This can often mean that the architectural solution will be driven by the desire to create a landmark building, with a complex or varying form and complex interfaces between the external envelope and structure.

07 / KEY COST DRIVERS FOR TALL BUILDINGS (+20 STOREYS)

Overall height The weight and cost of the structural frame per unit area will increase with height. Wind loading increases disproportionately with height and this has a significant impact on the design of the frame, resulting in a heavier frame weight than for the same floor plan in a low-rise building. This contributes to increasing the weight of the frame beyond the average range for a multi-storey building of fewer storeys and therefore increasing the cost.

Structural solution As the height of a building increases, the range of structural solutions that can be used will reduce. For tall buildings up to around 30 storeys, a traditional structural solution with a central primary structural core and regular columns can be used. But as the building height increases, this narrow primary structural form concentrated around service risers and vertical transportation/circulation may not provide effective resistance against wind loading. More complex structural solutions such as exterior framed tube, megabrace and vertical steel shear truss systems that use the building perimeter to resist wind loading may need to be explored. The eventual solution adopted will be influenced by site conditions as well as design aspirations and the project brief.

The overall height of the building is not the only cost driver that should be considered when assessing the frame cost of tall buildings. Other key factors include:

Function

A tall building containing a number of different uses will have more complexities than a building with a single occupancy. This may require the inclusion of complex structural elements, such as transfer structures and also reduces repetition across the building, with different spans and storey heights.

Building form

The shape, plan form, core location and column spacing will all impact on the structural design of a tall building and the frame cost. For example, a slender tall building will have a higher frame weight per m2 of floor area than the same height building with a larger floor plan, as it will need to be stiffer to resist the wind loadings.

Fire protection

A fire engineering approach should always be consideredfor tall buildings. While a consideration when cost planning any building, the implications of elective safety enhancements can have a significant impact on cost.

Core construction

Cores in tall buildings are more complex than in typical multi-storey buildings as they directly impact on both the floor plate and operational efficiency of the building. The structural frame design will be influenced by where the core is located - in the centre of the building or at the perimeter - as well as by whether the building is designed with a single large core or several smaller cores around the perimeter.

Placing a single core at the centre of the building is generally more efficient as it can be used to provide overall stability for the structure as well as bringing the advantage of maximising perimeter usable space and natural light.

However, where the floor plate size is constrained by a tight site, a central core may be inappropriate as it would result in small and inflexible floorplates.

Site constraints

As for any building, the site itself needs to be considered to determine its impact on the logistics of the frame construction and on preliminaries costs generally. The erection of the steel frame for a multi-storey building will typically cost between 10 and 15% of the overall steel frame cost; however, for a tall building the erection cost will increase due to the more complex movement of materials and labour.

It is important to maintain the speed of construction as the frame will be on a project’s critical path, so the allowance for sufficient craneage is paramount, coupled with the careful planning of deliveries and hook time. Consideration of preliminaries costs should also include whether they sit with the main contractor or specialist subcontractor and whether it would be beneficial to have site facilities located on upper levels so that the site operatives spend less time travelling to and from the workface throughout the day.

Depending on the procurement route, advice on how the frame will be constructed should be sought from a specialist subcontractor, with the craneage and delivery strategies influenced by the interfaces with adjacent buildings particularly important.

Specialist contractors

As a result of the characteristics of tall buildings, not all subcontractors will have the expertise, skills and experience to take on these projects. As each project will inherently be unique and therefore have a higher risk profile, not all specialist subcontractors have chosen to enter this part of the construction market. The procurement strategy for the project should therefore be considered during the cost planning stages to ensure that appropriate risk allowances have been taken into account. Engagement with a specialist subcontractor at an early stage will be beneficial.

The above factors can result in marked increases in the frame cost (including the core) of tall buildings compared with typical multi-storey buildings up to 15 storeys. The structural frame cost premium becomes significant quite quickly as the number of storeys increases: a 10-15% per unit cost premium should be expected for a 20-storey building compared with a 15-storey building, rising to 20% for a 30-storey building and up to 70-90% for a 45-60-storey building. As a general rule, large floor plates will be more economic due to their inherent ability to resist wind loadings with less additional stiffening.

08 / SUMMARY

The use of steel frame construction is dominant in the non-domestic multi-storey building sector and it is therefore important that the key cost drivers are fully understood to enable realistic cost plans to be produced during the design stages.

The key cost drivers for typicalmulti-storey buildings of between five and 15 storeys set out within this article provide guidance on how to assess an emerging design against standard cost ranges.

Additional factors that should be considered have also been explored for tall buildings; however, due to the unique nature of these structures and therefore difficulties associated with benchmarking or typical cost ranges, it is always important to seek as much information as possible from both the design team and a specialist steelwork contractor.

09 / COST MODEL UPDATE

Steel Insight Article 3, published on 20 April 2012, focused on a study of two typical commercial buildings to provide cost and programme guidance for quantity surveyors and design teams when considering the options available during the design and selection of a structural frame.

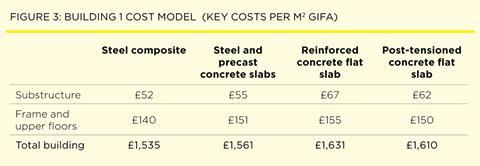

Building 1 considered a typical out-of-town speculative three-storey business park office building with a gross internal area of about 3,200m2 and a rectangular open-plan floor space. Cost models were developed for four frame types: steel composite, steel and precast concrete slab, reinforced concrete flat slab and post-tensioned concrete flat slab.

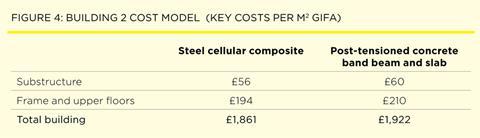

Building 2 considered an L-shaped eight-storey speculative city centre office building with a gross internal area of about 16,500m2 and a 7.5m x 15m grid. Cost models were developed for two frame types: steel cellular composite and post-tensioned concrete band beam and slab.

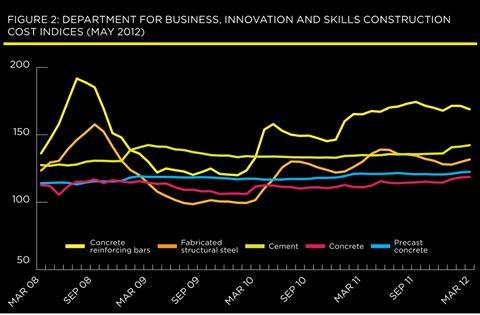

Following the initial publication of the study, the latest Department for Business Innovation and Skills (BIS) material price indices, published in May 2012, show some movement in material prices over the last quarter. However, our analysis of the market suggests that these are not necessarily being reflected in tender returns. The BIS figures show a 2% increase in the cement material price between February and April, which is translated into a 0.5% increase in the material price of ready-mix concrete and a 0.3% increase in the material price of pre-cast concrete products. As Figure 2 shows, while the indices for concrete products have shown a slightly rising trend throughout 2011 and into 2012, the fluctuation of concrete reinforcing bar prices and continued market uncertainty have acted to largely offset these increases in tender returns. Indeed, the May 2012 BIS material price for concrete reinforcing bar shows a 1.2% fall since February 2012.

The BIS indices also show a 0.9% increase in the material price of fabricated structural steel between February and April 2012, although, as Figure 2 shows, this is still a 2.4% reduction on the average material price from August to October 2011. Further analysis and market testing tends to suggest that this reflects market stabilisation rather than recovery.

Difficult economic conditions continue to affect not only the construction industry itself but also the economy generally both in the UK and internationally, with persisting eurozone uncertainty impacting on availability of funds and market confidence. These conditions have resulted in both structural steelwork and concrete tender returns remaining stable across the last quarter.

These factors also limit the prospects for any significant economic recovery across the remainder of 2012, particularly outside of London and the South-east, suggesting that tender returns are likely to remain largely stable across the rest of the year.

This is reflected in both the Building 1 and 2 cost model tables (Figures 3 and 4) and the structural steelwork cost table (Figure 5), where the cost ranges have remained constant since Steel Insight 3 in April 2012. This is also supported by the BCIS location factors which have shown little movement to the selected range of locations across the period (Figure 6).

As Figure 3 demonstrates, the steel composite beam and slab frame option remains the most competitive of all those considered for Building 1, with both the lowest frame and upper floors cost and lowest total building cost. This option benefits in particular from the lowest substructure costs due to the lighter frame weight and the lowest roof cost due to the lightweight steel roof deck.

As Figure 4 demonstrates, the cellular steel composite option has both a lower frame and floor cost and lower total building cost than the post-tensioned concrete band beam option, benefiting from lower substructure costs, a lower roof cost and a lower floor-to-floor height, resulting in a lower external envelope cost.

To use the indicative cost table below, a) identify which frame type most closely relates to the project under consideration, b) select and add the floor type under consideration, and c) add fire protection if required.

The costs are presented in two columns: one for the BCIS Index 100 and one for the City of London. For other locations, rates should be adjusted using location indices; Figure 6 contains a selection of indices as published and updated by the BCIS.

As highlighted in previous Steel Insights, before using such “standard” ranges it is important to confirm the anticipated frame weight and variables such as the floor-to-floor heights with the design team to determine whether they are above or below the average and to adjust the rate used accordingly.

Similarly, all of the other key cost drivers of complexity, site conditions, location, function, logistics, programme and procurement strategy should be considered in turn.

THE STEEL INSIGHT SERIES

This article was produced by Rachel Oldham (associate) and Alastair Wolstenholme (partner) of Gardiner & Theobald. It is the fourth in a series that provides guidance on the realistic costing of structural steelwork. The next Steel Insight will appear on 26 October 2012. If you are considering using structural steelwork for your building, bridge or structure, we recommend an early dialogue with a specialist steelwork contractor. They can offer a range of support and advice, including budget estimates and value engineering. Steelwork contractors can be sourced according to project size and technical competency. This searchable function is available at www.steelconstruction.org

No comments yet