The data shows that the fall in the value of the pound is likely to lead to a period of inflation, with prices rising. Michael Dall discusses the highlights of Barbour ABI’s monthly Economic & Construction Market Review

Economic context

The Office for National Statistics (ONS) revised its initial estimate for the second quarter up to 0.7% growth from the original figure of 0.6%. It re-confirmed the patterns of economic activity in the lead up to the EU referendum, with strong growth occurring between April and June.

The value of sterling continued to fall and it is the worst performing major currency this year as the markets reacted to the possibility of the UK leaving the single market. According to Reuters, the pound reached its lowest value since the euro was introduced in 1999 and fell below $1.21, compared with $1.48 on the 23 June, the day of the referendum.

The fall in the value of the pound is expected to herald a period of higher inflation and there is evidence of this in the latest figures. The most recent data released shows that the consumer price index rose to 1% in September, 0.4% higher than in the previous month.

The increase is attributable to higher prices for clothing, hotel stays and motor fuels.

Other news this month on the UK economy includes:

- A survey by Deloitte found that nine out of 10 chief financial officers said business uncertainty was higher than normal

- The International Monetary Fund revised its forecast for UK growth in 2017 down to 1.1% from 1.3% in July

- The British Retail Consortium and KPMG survey showed that retail sales rose by 1.3% in September compared to last year.

The latest figures from the ONS indicate the construction sector in the UK declined by 1.5% between July and August 2016. Comparing August output levels with the same period in 2015 showed an increase of 0.2%.

There were monthly decreases across all sectors except private commercial work. infrastructure and public housing output saw the largest declines

There were monthly decreases across all sectors in construction, except private commercial work, which increased by 1.5%. Infrastructure and public housing output saw the largest declines, of 5.1% and 6.3% respectively. Comparing the figures to the corresponding month last year showed that private housing output was 9.4% higher but infrastructure was 9.3% lower than August 2015.

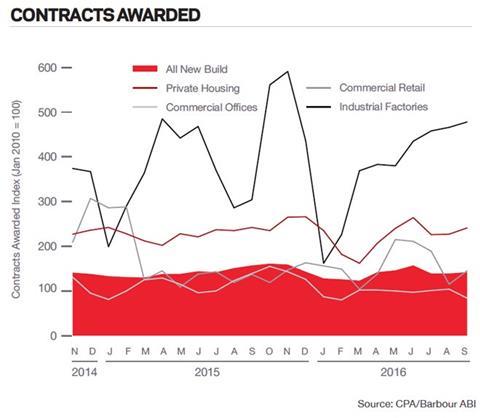

The CPA/Barbour ABI Index, which measures the level of contracts awarded using January 2010 as its base month, recorded a reading of 142 for September (see graph, right). This is an increase from the previous month’s figure of 139 and suggests that activity in the industry is increasing after an initial decline after the EU referendum result.

The readings for private housing improved to register a reading of 241, up from 227 for the previous month. Commercial retail increased sharply from 115 to 145 but commercial offices fell from 104 to 84, presenting a mixed picture at a sector level.

Construction sector

According to Barbour ABI data on all contract activity, September witnessed an increase in construction levels, with the value of new contracts awarded £5.6bn, based on a three month rolling average (see graph, right). This is a 2.4% increase from August but is 17.6% lower than the value recorded in September 2015. The number of construction projects within the UK in September decreased by 1.5% on August, and were 11.7% lower than September 2015.

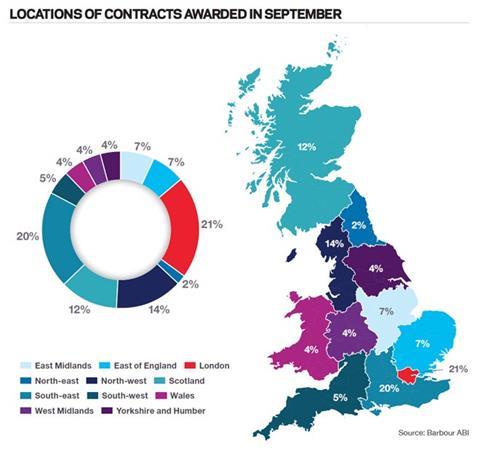

The majority of the contracts awarded in September by value were in London, accounting for 21% of the UK total. This was followed by the South-east with 20% of contract award value in the month (see pie chart and map, opposite). The main reason for London’s figures being ahead this month was the award for the Crown House residential development on City Road. The development at is set to deliver 302 units at a value of £170m and was awarded to Mace. In the South-east, the largest contract award was the M4 junction 3-12 smart motorway scheme, which was awarded to Balfour Beatty and Vinci at a value of £657.3m.

Types of project

Infrastructure had the highest proportion of contracts awarded by value in September, with 32% of the total. This was closely followed by the residential sector, which accounted for 29% of the awarded value. The two aforementioned contracts are the main reasons for the sector’s strong showing in September.

Construction performance by sector

Spotlight on hotel, leisure and sport

Contract award levels in this sector were £506m in September, based on a three month rolling average. This is 24.5% higher than in August and 99% higher than in September 2015.

In the three months to September, the value of contracts was £1.3bn, 20.1% higher than in the previous three months. This was an increase of 52.6% on the same period in 2015.

Projects by region

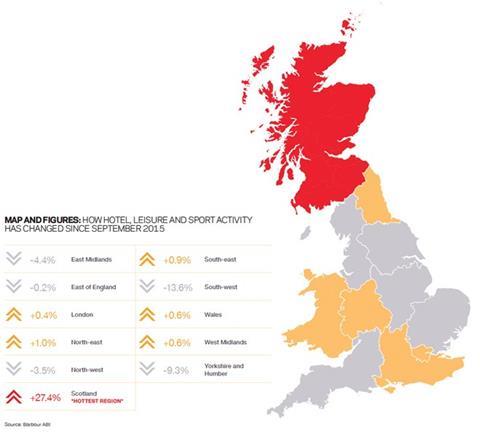

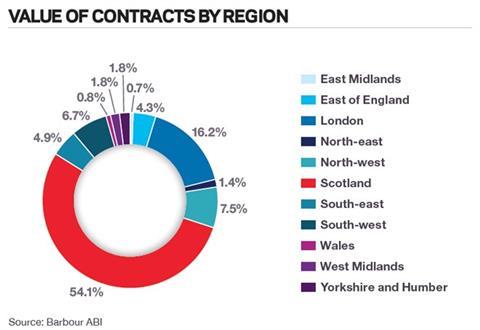

Scotland was the main location for contracts, accounting for 54.1% of the value awarded, 27.4% higher than in September 2015 (see below and pie chart).

The largest individual contract was for the Aberdeen Exhibition and Conference Centre development, valued at £330m, which includes a 200-bedroom hotel and some demolition. London had the next highest share of contract value at 16.2%, a rise of 0.4% on last year. The largest contract awarded in the region was the Brentford Football Club Stadium, with a value of £40m.

Type of projects

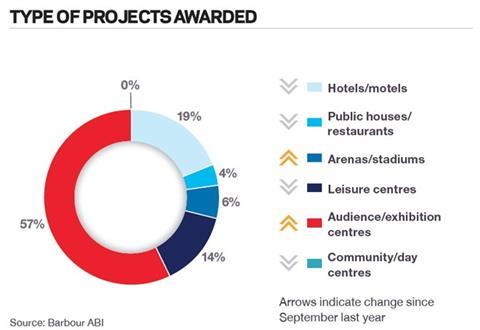

The Aberdeen contract means that audience/exhibition centres accounted for the highest proportion of activity at 57%, a 41% rise from the same month last year. The usually dominant hotels/motels sector accounted for 21% of the value of contracts, 35% less than in September 2015 (see pie chart).

Click here for the full Economic & Construction Market Review >>

Downloads

Economic Construction Market Review – October 2016

PDF, Size 0 kb

No comments yet