Costing Steelwork is a series from Aecom, BCSA and Steel for Life that provides guidance on costing structural steelwork. This quarter provides a market update and updates the five cost models previously featured in Costing Steelwork.

Click here to read the full costing report

The covid-19 (coronavirus) outbreak spreading rapidly across the world has upended global and domestic economies. At the time of writing, the pandemic is creating a rapidly evolving situation, with expected large impacts to economies and domestic industry sectors across the world.

Until the outbreak, UK business sentiment indicators were holding up, broadly speaking, against a backdrop of general uncertainty. Measures of business confidence had made something of a rebound over Q1 2020.

The UK’s GDP annual growth rate to Q4 2019 was just over 1%, confirming an otherwise benign trend throughout 2019. Brexit was a constant theme within supporting commentary to the hard data. Nevertheless, corresponding mitigation activities, such as stockpiling, helped keep economic activity from declining further.

The UK’s GDP annual growth rate to Q4 2019 was just over 1%, confirming an otherwise benign trend throughout 2019. Brexit was a constant theme within supporting commentary to the hard data

In the main, sentiment surveys for construction indicated prevailing weakness throughout 2019 but, as in broader business surveys, sentiment picked up in early 2020. Construction new work output grew at over 3% year-on-year in Q4 2019. Revisions to the data set helped to propel this rate of expansion, after what was looking like an uneven year of industry growth. At 0.5%, the quarter-on-quarter movement for the all work measure was welcome but not stellar. All construction sub-sectors recorded yearly growth, except for repair and maintenance, which declined marginally over the year. Workload momentum was clearly evident in the output data until the coronavirus outbreak.

Total new orders for new work showed no real improvement on a yearly change basis in Q4 2019. This was an improvement on the Q3 figure, which showed a -6.7% decline over the year. But the quarter-on-quarter change at Q4 2019 was somewhat more reassuring at 4.4% growth. Sector breakdown shows that the usual stalwarts of industry growth – housing and infrastructure – both saw falls in new work between Q4 2018 and Q4 2019. Public sector work also recorded a drop but commercial new orders rose.

Sterling moved out of its range-bound course of the past three years after the general election in December last year. The optimism was short-lived, though, and sterling retreated back into its prior range. This suggests that markets were withholding judgment on the UK’s future until definitive aspects of a UK/EU trade deal become clear. Before the coronavirus outbreak began, inflationary pressures were set to remain as a result of sterling’s value against the US dollar and euro. Sterling’s range-bound path until Q1 2020 was beginning to be considered the “new normal”, given its prolonged duration at this level. Anchored to this range, it is very likely that the construction supply chain would experience ongoing pressure on its input costs.

Before the coronavirus outbreak began, inflationary pressures were set to remain as a result of sterling’s value against the US dollar and euro

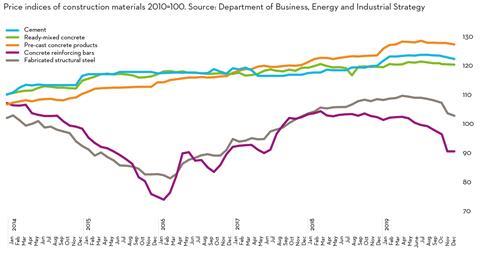

Aecom’s composite index for building costs – comprised of materials and labour inputs – rose by 3.4% over the year at Q4 2019. The Q4 number eased marginally but not significantly enough to change the prevailing cost and price dynamics that the supply chain continued to grapple with. There was an average fall of -0.7% across all inputs between Q3 and Q4. The largest falls were recorded in metal decking (-6%), concrete reinforcement (-4%) and steel doors and windows (-4%). Only one item, precast concrete (0.4%), showed an increase over the quarter.

An aggregate measure of wage rates for site labour rose by just under 2% annually in Q4 2019. Tellingly, UK construction supply chain capacity measures tightened somewhat towards the end of 2019 despite a slower rate of wage inflation. The part-reversal of available capacity over a short period of time in Q3 and Q4 2019 emphasises the prevailing capacity tightness of the construction sector. If there had been a much-vaunted Brexit bounce, spare labour market capacity would very probably have quickly disappeared. A commensurate increase in wage rates would have quickly followed.

Tender prices increased by 2.3% over the year at Q4 2019. Keener pricing was evident, although it was not consistent across all trade packages, nor all of the UK. Early works trades saw particularly lean pricing, which is commensurate with slackness in preliminary works activity. Because rates of price change are lower, albeit marginally, than rates of change for input costs, commercial pressure for construction firms continues.

The pandemic has brought some restrictions on the movement of goods and materials, as well as people, along with site shutdowns. The extent to which these continue will be determined by the progression of the coronavirus outbreak. Similarly, the financial effects to the supply chain will only become evident in the upcoming months.

Sourcing cost information

Cost information is generally derived from a variety of sources, including similar projects, market testing and benchmarking. Due to the mix of source information it is important to establish relevance, which is paramount when comparing buildings in size, form and complexity.

Figure 3 represents the costs associated with the structural framing of a building, with a BCIS location factor of 100 expressed as a cost/m² on GIFA. The range of costs represents variances in the key cost drivers. If a building’s frame cost sits outside these ranges, this should act as a prompt to interrogate the design and determine the contributing factors.

The location of a project is a key factor in price determination, and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS location factors (figure 4), highlight the existence of different market conditions in different regions.

Figure 1: Material price trends

Figure 2: Tender price inflation, Aecom Tender Price Index, 2015=100

| Forecast* | |||||||

|---|---|---|---|---|---|---|---|

|

Quarter |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

1 |

110.9 |

113.2 |

117.9 |

120.6 |

– |

– |

– |

|

2 |

111.3 |

113.6 |

118.3 |

– |

– |

– |

– |

|

3 |

112.2 |

115.4 |

119.3 |

– |

– |

– |

– |

|

4 |

112.6 |

117.3 |

120.0 |

– |

– |

– |

– |

* Meaningful forecasts are not possible at this time on the basis that the short- to medium-term impact of the covid-19 pandemic on the industry is unknown.

Figure 3: Indicative cost ranges based on gross internal floor area

| TYPE | Base index 100 (£/m2) | Notes |

|---|---|---|

|

Frames |

||

|

Steel frame to low-rise building |

102-124 |

Steelwork design based on 55kg/m2 |

|

Steel frame to high-rise building |

171-193 |

Steelwork design based on 90kg/m2 |

|

Complex steel frame |

193-228 |

Steelwork design based on 110kg/m2 |

|

Floors |

||

|

Composite floors, metal decking and lightweight concrete topping |

62-95 |

Two-way spanning deck, typical 3m span with concrete topping up to 150mm |

|

Precast concrete composite floor with concrete topping |

102-144 |

Hollowcore precast concrete planks with structural concrete topping spanning between primary steel beams |

|

Fire protection |

||

|

Fire protection to steel columns and beams (60 minutes resistance) |

15-20 |

Factory applied intumescent coating |

|

Fire protection to steel columns and beams (90 minutes resistance) |

17-29 |

Factory applied intumescent coating |

|

Portal frames |

||

|

Large-span single-storey building with low eaves (6-8m) |

75-98 |

Steelwork design based on 35kg/m2 |

|

Large-span single-storey building with high eaves (10-13m) |

86-119 |

Steelwork design based on 45kg/m2 |

Figure 4: BCIS location factors, as at Q4 2019

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

|

Central London |

131 |

Nottingham |

105 |

|

Manchester |

101 |

Glasgow |

94 |

|

Birmingham |

94 |

Newcastle |

91 |

|

Liverpool |

96 |

Cardiff |

90 |

|

Leeds |

92 |

Dublin |

97* |

*Aecom index

Steel For Life sponsors

Headline

Gold

Ficep UK Ltd, National Tube Stockholders and Cleveland Steel & Tubes, Peddinghaus Corporation, voestalpine Metsec plc, Wedge Group Galvanizing Ltd

Silver

Jack Tighe Ltd, Kaltenbach Ltd, Tata Steel, Trimble Solutions (UK) Ltd

Cost comparison updates

This quarter’s Costing Steelwork provides an update of the five previously featured cost comparisons covering: offices, education, industrial, retail and mixed-use

These five projects were originally part of the Target Zero study conducted by a consortium of organisations including Tata Steel, Aecom, SCI, Cyril Sweett and the BCSA in 2010 to provide guidance on the design and construction of sustainable, low- and zero-carbon buildings in the UK. The cost models for these five projects have been reviewed and updated as part of the Costing Steelwork series. The latest cost models as of Q1 2020 are presented here.

Costing steelwork: offices update

Below is an update to the offices cost comparison originally published in the Costing Steelwork Offices feature in Building magazine in April 2017.

One Kingdom Street, London, key features

- 10 storeys, with two levels of basement

- Typical clear spans of 12m x 10.5m

- Three cores – one main core with open atrium, scenic atrium bridges and lifts

- Plant at roof level

Cost comparison

Two structural options for the office building were assessed (as shown in figure 5):

- Base case – a steel frame, comprising fabricated cellular steel beams supporting a lightweight concrete slab on a profiled steel deck

- Option 1 – 350mm-thick post-tensioned concrete flat slab with a 650mm x 1,050mm perimeter beam.

The full building cost plans for each structural option have been reviewed and updated to provide current costs at Q1 2020. Movement has continued to be relatively static from Q4 2019. The costs, which include preliminaries, overheads, profit and a contingency, are summarised in figure 5.

The cost of the steel composite solution is 7% lower than that for the post-tensioned concrete flat slab alternative for the frame and upper floors, and 5% lower on a total building basis.

Figure 5: Key costs £/m² (GIFA), for City of London office building

| Elements | Steel composite | Post-tensioned concrete flat slab |

|---|---|---|

|

Substructure |

89 |

95 |

|

Frame and upper floors |

442 |

476 |

|

Total building |

2,665 |

2,798 |

Costing steelwork: education update

Below is an update to the education cost comparison originally published in the Costing Steelwork Education feature in Building magazine in July 2017.

Christ the King Centre for Learning, Merseyside, key features

- Three storeys, with no basement levels

- Typical clear spans of 9m x 9m

- 591m2 sports hall (with glulam frame), 770m2 activity area and atrium

- Plant at roof level

Cost comparison

Three structural options for the building were assessed (as shown in figure 6), which include:

- Base case – steel frame, 250mm hollowcore precast concrete planks with 75mm structural screed

- Option 1 – in situ 350mm reinforced concrete flat slab with 400mm x 400mm columns

- Option 2 – steel frame, 130mm concrete topping on structural metal deck.

The full building cost plans for each option have been updated to provide current costs at Q1 2020. The comparative costs highlight the importance of considering total building cost when selecting the structural frame material.

The concrete flat slab option has a marginally lower frame and floor cost compared with the steel composite option, but on a total-building basis, the steel composite option has a lower overall cost £3,159/m2 against £3,185/m2. This is because of lower substructure and roof costs, alongside lower preliminaries resulting from the shorter programme.

Figure 6: Key costs £/m² (GIFA), for Merseyside secondary school

| Elements | Steel + precast hollow-core planks | In situ concrete flat slab | Steel composite |

|---|---|---|---|

|

Frame and upper floors |

294 |

254 |

267 |

|

Total building |

3,216 |

3,185 |

3,159 |

Costing steelwork: industrial update

Below is an update to the industrial cost comparison originally published in the Costing Steelwork Industrial feature in Building magazine in October 2017.

Distribution warehouse in ProLogis Park, Stoke-on-Trent, key features

- Warehouse: four-span, steel portal frame, with a net internal floor area of 34,000m2

- Office: 1,400m2, two-storey office wing with a braced steel frame with columns

Cost comparison

Three frame options were considered:

- Base option – a steel portal frame with a simple roof solution

- Option 1 – a hybrid option: precast concrete column and glulam beams with timber rafters

- Option 2 – a steel portal frame with a northlight roof solution.

The full building cost plans for each option have been updated to provide costs at Q1 2020. The steel portal frame provides optimum build value at £691/m2; glulam is least cost-efficient. This is primarily due to the cost premium for the structural members necessary to provide the required spans, which are otherwise efficiently catered for in the steelwork solution.

With a hybrid, the elements are from different suppliers, which raises the cost. The northlights option is directly comparable with the portal frame in relation to the warehouse and office frame. The variance is in the roof framing as the northlights need more. Other additional costs relate to the glazing of the northlights.

Figure 7: Key costs £/m2 (GIFA), for Stoke-on-Trent distribution warehouse

| Elements | Steel portal frame | Glulam beams + purlins + concrete columns | Steel portal frame + north-lights |

|---|---|---|---|

|

Warehouse |

71 |

144 |

84 |

|

Office |

131 |

173 |

131 |

|

Total frame |

75 |

145 |

88 |

|

Total building |

691 |

774 |

743 |

Costing steelwork: retail update

Below is an update to the retail cost comparison originally published in the Costing Steelwork retail feature in Building magazine in January 2018.

Asda food store, Stockton-on-Tees,

key features

- Total floor area of 9,393m2

- Retail area based on 12m x 12m structural grid

Cost comparison

Three frame options were considered (as shown in figure 8) to establish the optimum solution for the building, as follows:

- Base option – a steel portal frame on

CFA piles

- Option 1 – glulam timber rafters and columns on CFA piles

- Option 2 – a steel portal frame with a northlight roof solution on driven steel piles.

The full building cost plans for each option have been updated to provide costs at Q1 2020. The steel portal frame provides the optimum build value at £2,629/m2, with the glulam option the least cost-efficient. The greater cost is due to the direct comparison of the steel frame solution against the glulam columns and beams/ rafters. A significant proportion of the building cost is in the M&E services and fit-out elements, which reduce the impact of the structural changes.

The northlights option is directly comparable with the portal frame in relation to the main supermarket – the variance is in the roof framing as the northlights require more. Additional costs beyond the frame are related to the glazing of the northlights and the overall increase in relative roof area.

Figure 8: Key costs £/m2 (GIFA), for Stockton-on-Tees food store

| Elements | Steel portal frame | Glulam timber rafters + columns | Steel portal frame + north-lights |

|---|---|---|---|

|

Structural unit cost |

145 |

177 |

163 |

|

Total building unit cost |

2,629 |

2,669 |

2,639 |

Costing steelwork: mixed-use update

Below is an update to the mixed-use cost comparison originally published in the Costing Steelwork mixed-use focus feature in Building magazine in April 2018.

Holiday Inn tower, MediaCityUK, Manchester

- 17-storey tower

- 7,153m2 of open-plan office space on five floors (floors two to six)

- 9,265m2 of hotel space on eight floors (floors eight to 15)

The gross internal floor area of the building is 18,625m2. The 67m-high building is rectilinear with approximate dimensions of 74m x 15.3m.

Cost comparison

Three frame options were considered to establish the optimum solution for the building:

- Base option – steel frame with Slimdek floors

- Option 1 – concrete flat slab

- Option 2 – composite deck on cellular beams (offices) and UCs used as beams (hotel).

The full building cost plans for each option have been updated to provide costs at Q1 2020. The steel frame with composite deck continues to provide the optimum build value, with the overall building cost at £2,600/m2.

Options 1 and 2 are arguably more typical for this building type. The base case structure is an unusual solution due to a decision to change the residential accommodation to office floors at a very late stage – time constraints precluded redesign of the tower block, hence the original Slimdek design was constructed.

Figure 9: Key costs £/m2 (GIFA), for hotel/office building in Manchester

| Elements | Steel frame with Slimdek | Concrete flat slab | Composite deck on cellular beams (offices) and UCs used as beams (hotel) |

|---|---|---|---|

|

Structural unit cost |

518 |

433 |

354 |

|

Total building unit cost |

2,809 |

2,705 |

2,600 |

This Costing Steelwork article produced by Patrick McNamara (director) and Michael Hubbard (associate) of Aecom is available at www.steelconstruction.info.

The data and rates contained in this article have been produced for comparative purposes only and should not be used or relied upon for any other purpose without further discussion with Aecom. Aecom does not owe a duty of care to the reader or accept responsibility for any reliance on the article contents.

No comments yet