Market Data – Page 10

-

Features

FeaturesTracker: October 2013

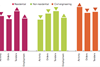

Only non-residential bucks the downward trend for the construction activity index, while employment and tender price indices also see dramatic dips

-

Features

FeaturesTracker: September 2013

Indices for activity, orders and enquiries are all still in positive territory, but the growing problem of material and equipment shortages needs keeping an eye on

-

Features

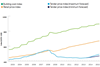

FeaturesMarket forecast: A confidence shift

Leading indicators highlight renewed optimism. But don’t break open the champagne just yet …

-

Features

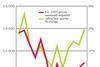

FeaturesLead times: July - September 2013

Most works packages continue to be unmoved, but increased activity means that some rises are expected in the months ahead. Brian Moone of Mace Business School summarises the data

-

Features

FeaturesTracker: August 2013

It’s the eighth month in positive territory for the construction activity index, and with positive signs in the regions as well, things seem to have taken a turn for the better, says Experian Economics

-

Features

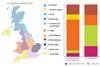

FeaturesBuilding intelligence Q2 2013

Data from Experian Economics shows that construction output in Q2 saw a slight improvement, but new work orders have soared by 20% and public housing is looking strong

-

Features

FeaturesTracker: July 2013

Activity has dipped slightly since the five-year high last month, but orders are looking healthy and there is also positive news for employment for the first time since 2007, as Experian Economics reports

-

Features

FeaturesThe Tracker: June 2013

Last month construction activity reached its highest level since October 2007, with civil engineering experiencing the largest increase. Experian Economics reports

-

Features

FeaturesLead times April - June 2013

Enquiries and workload continue to increase but in a bid to remain competitive, most suppliers are expecting lead times to hold steady. Brian Moone of Mace reports

-

Features

FeaturesMarket forecast: Turning a corner?

Although last month’s Spending Round left a lot to be desired, there are plausible signs of a tentative recovery in construction

-

Features

FeaturesTracker: May 2013

Construction activity hit its highest level in six months and the picture for contractors in six of the regions is looking more positive too. Experian Economics reports

-

Features

FeaturesBuilding intelligence: Q1 2013

Data from Experian Economics shows that construction output in Q1 was some 23% below 2008 levels. But GDP edged up, and industrial output is looking healthy

-

Features

FeaturesThe tracker: April 2013

Construction activity increased in April as did orders, employment and tender prices. However, Experian Economics reports that financial constraints remain a drag on growth

-

Features

FeaturesLead times: Jan-Mar 2013

Lead times have been static for most suppliers in the first quarter of the year despite some reporting increased enquiries and workloads

-

Features

FeaturesThe tracker: March 2013

Construction activity fell last month but remains in positive territory, although orders are falling and are down on what they should be for the time of year. Experian Economics analyses the statistics

-

Features

FeaturesMarket Forecast: The longest winter

Tender prices are flat, with nowhere left to fall, and output in January and February was very low. But is the housing sector showing signs of spring? By Peter Fordham of Davis Langdon, an Aecom company

-

Features

FeaturesThe Tracker: February 2013

Activity rose in February on the back of a sharp increase in civil engineering work - and it was a strong month for orders too. Experian Economics crunches the numbers

-

Features

FeaturesBuilding intelligence

Data from Experian Economics shows that the first quarterly rise in construction output since the second quarter of 2011 ocurred in fourth quarter of last year. However, not all the trends are positive

-

Features

FeaturesThe tracker: The pain continues

Despite bad weather in January, construction activity levels went into positive territory. But, according to Experian Economics, any gains at the start of the year will be lost in the coming months

-

Features

FeaturesLead times Oct-Dec 2012

Despite some reports of increasing enquiries and workload, lead times have held steady for the most part as suppliers try to stay competitive. Brian Moone of Mace reports